Which among the following plans includes a provision that places a maximum limit on the amount that can be withdrawn during a calendar year?

Exchange traded funds (ETFs) that track an index and index mutual funds have many similarities. However, what is a major difference between these two products?

Jabir begins the registration process with his new dealer Prosper Wealth Inc. Jabir is excited about his new career and eager to start calling clients, opening new accounts, and selling investments. Which of the following CORRECTLY describes when Jabir will be eligible to open new client accounts and sell investments?

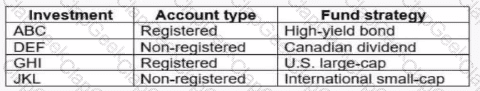

Matthew is planning on making the following investments in December:

Assuming all four investments have performed well throughout the year, which investment will trigger the highest unexpected taxes?

Sarah and Kyle are a married couple. They are both 34 years of age and work as teachers. Their combined annual income is $130,000. They are able to save $800 each month. They own a home worth

$340,000 with a $120,000 mortgage. Since they work for the same employer, they have the same defined benefit pension plan. Other than a tax-free savings account (TFSA) in Kyle's name with $5,000, they do not have any other assets.

They are avid sailors and want to save towards a purchase of a sailboat. For the type of sailboat they want, they estimate it should cost around $65,000. They want you to recommend an investment for their monthly savings to help them achieve their goal faster.

What question should you ask them next?

What does relative performance seek to compare between a fund and the other funds in its category?

Maureen is 65 years old and will be retiring soon. She has a modest portfolio of mutual funds that focus on growth. As she approaches retirement, Maureen wants to switch to investments that provide steady income with low to medium risk.

Given Maureen’s wishes, which of the following mutual funds would be suitable for her?

Which newspaper article would be likely to result in foreign capital moving out of a country?

Evan owns retractable preferred shares of Ingram Corp. Which statement CORRECTLY describes a key feature of Evan's shares?

Which behavioural bias causes a person to rely on a “best-fit” process to form the basis for understanding a new circumstance?

While assessing the suitability of an investment recommendation as a Dealing Representative, which statement applies to the "Client's Interest First" standard?

Which drawback of the comparison universe method makes average fund managers look more like underperformers as the comparison period lengthens?

An Investor is making annual withdrawals from their mutual fund as follows:

Based on the withdrawal schedule, what type of withdrawal plan are they using?

During the calendar year, Firmansyah received a $1,800 eligible dividend from a large Canadian bank and a $US dollar (USD) dividend of $882.02 from a foreign-based corporation. The USD/CAD exchange rates is 1.3605.

Firmansyah's federal marginal tax bracket is 29%. The enhanced dividend gross-up rate is 38% and the federal dividend tax credit rate for eligible dividends is 15%.

What federal tax liability will be result from his investment income?

Your client, Rinaldo, wants to know more about the fees associated with his mutual funds. What can you tell him about a mutual fund’s management expense ratio (MER)?

Which of the following Dealing Representatives has fulfilled their "Know Your Product" obligation?

An investor with rudimentary investment knowledge is considering various recommendations. Assuming the investor’s risk-return profile suggests risk-seeking interests, which recommendation is most appropriate?

Your client earns $100,000 from employment and $10,000 from investments each year. Her bills total $95,000 annually. What is her discretionary income?

Eleanora receives a $500 eligible Canadian dividend from her mutual fund. Her federal marginal tax rate for the year is 29%. Assuming the enhanced gross-up of 38% and a federal dividend tax credit of 15.02%, how much federal tax will she pay on her dividend?

Portia is a Dealing Representative with Highview Wealth Inc., a mutual fund dealer. Portia recommends the Stature Growth Fund to her client Clive. Which of the following CORRECTLY describes what Portia must do in order to satisfy her obligations under the Client Relationship Model (CRM) and Client Focused Reforms (CFR)?

Faruq is a Dealing Representative with Smart Planning Group, a mutual fund dealer. Faruq meets with his new client, Taline, and learns that she lives on a low, fixed income.

Taline tells Faruq that she wants to maximize her investment returns as high as possible to make up the difference. Taline also indicates that she cannot afford large investment losses because her income is low. Which of the following CORRECTLY describes how Faruq should assess Taline’s risk profile?

Natasha currently owns 2 mutual funds: a bond fund and a Canadian equity fund. She would like to use one of them as her registered retirement savings plan (RRSP) contribution for the year. From a tax efficiency perspective, which mutual fund should she contribute?

Sonya meets with her client Elijah to review different investment approaches that could be offered to help him reach his financial goals. Part of that discussion included Sonya mentioning factors such as

inflation, interest rates, and rates of return. Which stage of the Strategic Investment Planning (SIP) process does this describe?

Josephine is a Dealing Representative with Sunshine Mutual Funds Inc. for over 10 years. Her brother Jonathan has an account with Sunshine Mutual Funds Inc., too. Jonathan wants Josephine to manage his

portfolio and make investment decisions on his behalf. Jonathan trusts his sister to make better investment choices than he can. He also wants to give Power of Attorney (POA) to Josephine so she can have full authority over his account.

How can Josephine respond to her brother's request?

Quinton, a Dealing Representative, meets with his client Banji. Banji’s Know Your Client (KYC) indicates that her risk profile is “medium’’. Banji currently has $35,000 in her account which is invested 50% in the Middleton Balanced Fund and 50% in the Hector Growth Fund. She tells Quinton that she would like to contribute an additional $10,000 to purchase the Prospect Labour-Sponsored Fund. Which of the following statements about Banji’s proposed transaction is CORRECT?

Which type of fixed income fund has a short duration, with the objectives of preserving capital and generating better current income than a money market fund?

You are the portfolio manager for the ABC asset allocation fund. Interest rates are going up; the stock market has been very volatile recently and is forecast to continue that way for the next two quarters. What changes, if any, will you make to your current asset allocation of 50% bonds and 50% equities?

Which of the following individuals would qualify for a full or partial Old Age Security (OAS) pension?

Charlotte has received proceeds from a deceased family member’s estate. Charlotte decides to visit Malik, who’s a Dealing Representative at her bank. She tells Malik, she does not know much about trading ETFs, but she wants to invest in ETFs. Charlotte says she feels fortunate to have this money and that she’s not worried about losing it because she never planned on having any of it.

What element of the Know Your Client (KYC) information has Malik been able to learn?

Which document contains information regarding the Independent Review Committee compensation?

Lucas wants to participate in the Lifelong Learning Program (LLP). He currently has $10,000 in his registered retirement savings plan (RRSP) for this purpose. He plans to make his maximum permitted

withdrawal of $10,000 under the LLP in two months. Based on this information, what would be his investment objective for the $10,000 currently sitting in his RRSP?

Cristina wants to add a mutual fund to her portfolio offering dividend income. She is considering either a preferred dividend fund or a standard equity fund. What is an important difference for Cristina to consider when comparing these two types of funds?

Which financial instrument gives its purchaser the right to vote at the issuing company’s annual meeting?

In what circumstance would an investor receive a T3 or T5 reporting a capital gain from a mutual fund investment?

Beatrice is looking for comprehensive information regarding the analysis of financial statements and fund management expenses as it relates to her current mutual fund investment.

Which document would provide the information she is looking for?

Calculate the 2-year simple return for the AAA Mutual Fund.

AAA Mutual Fund Performance

Year | Price at Beginning | Distribution | Price at End | Simple 1-Yr Return

1st Year | $10.00 | $0.25 | $11.00 | 12.50%

2nd Year | $11.00 | $0.25 | $10.20 | -5.00%

What may be used to determine which of two bond portfolios is more sensitive to interest rate changes?

Which of the following is included when calculating a country's gross domestic product (GDP)?

Which of the following form part of the disclosure documents relating to mutual funds?

What type of mutual fund can invest in specified derivatives and forward contracts for grains, meats, metals, energy products, and coffee?

Armand, a financial advisor, recently met with Austin, a potential client. Austin is interested in a conservative portfolio that focuses on mature companies that are out of favour with a low turnover. What is the best investment philosophy for Austin?

Which of the following statements are CORRECT about labour sponsored investment funds (LSIFs)?

The following data is available for an investment:

Purchase value

$125

End of the year value

$133

Quarterly dividend amount

$1

What is the annual return for this investment if held for one year?

Xian-Li believes she is a sophisticated investor. She has constructed her own portfolio and has had some success. She does not believe in studying a company’s details such as earnings, expenses, or assets. She is more concerned with patterns in a company’s stock price over time. She believes patterns form and can be used to predict future movements in the market.

How does Xian-Li evaluate the companies in her portfolio?

When comparing mutual funds, what information would help a Dealing Representative determine a suitable mutual fund for a client?

An investor wishes to add another security to his portfolio. He is looking at a stock that has a correlation with the portfolio of 0.99. What should the advisor tell this investor?

Jeremy is reviewing the prospectus of a Canadian equity fund and notes the fund permits the use of derivatives. The stated objective of the derivative use is bet on the future movement of the market to increase the fund's returns. What should Jeremy be aware of regarding this fund?

Which statement best describes what a rational investor will do when comparing the risk and return of two investments?

Helen is an experienced investor and after all these years she believes that the market is completely efficient. What action would she undertake?

Jabir recently joined Prosper Wealth Inc. and is looking forward to being a Dealing Representative for the firm. Which of the following statements CORRECTLY describe when Jabir will be eligible to open new

client accounts and sell investments?

A fund manager is selling industrial sector stocks and using the proceeds to overweight the portfolio in financial services stocks to take advantage of her belief of changes in the business cycle. What equity investing philosophy describes this approach?

Nancy received a $160 taxable dividend from Can-Star Ltd., whose shares she holds in her non-registered account. Can-Star is a taxable Canadian corporation. What is the approximate amount of the dividend tax credit Nancy will receive on the shares?

Hamid, the portfolio manager of the Trabant Canadian Equity Fund is deciding on some new investments. He has identified a retirement residence company as well as a discount clothing retailer that both seem to have good prospects and appear undervalued. What investment approach is Hamid using?

Your client, a high-income earner in a high marginal tax bracket, is seeking to minimize the amount of tax he pays on investment income while continuing to invest in mutual funds. Which mutual fund would best meet his investment objective?

What amount of Canadian taxes would an investor with a 33% marginal tax rate pay on a $5,000 dividend payment from a foreign corporation?

Reagan has accepted a role to be the Chief Revenue Officer of a charitable organization. She is currently registered as a Dealing Representative for Sunshine Financial Services.

Which of the following would apply to her?

Which of the following statements describes a feature of the Home Buyers’ Plan (HBP)?

For the last year, an investor earned a return before adjustment for inflation of 2% on a money market fund, while inflation averaged 1.5%. What was his nominal rate of return?

Gershon is a Dealing Representative and he opens a new account for his client, Isaac. Gershon collects the necessary information from Isaac in order to designate the Trusted Contact Person (TCP) for Isaac’s account. Which of the following statements about Isaac’s TCP is CORRECT?

Rashad is a Dealing Representative with Investors Network Corp., a mutual fund dealer. Investors Network is registered in all provinces and territories of Canada and Rashad is registered in the Edmonton,

Alberta branch. Rashad is told to provide his Branch Manager with a number of client files. The client files will be part of a compliance review by the applicable self-regulatory organization (SRO). Which

regulator will review Rashad's client files?

What type of pension plan usually provides better protection against inflation up to the time of retirement?

What items are typically classified as current assets on the statement of financial position?

Lucas is 60 years old and continues to work. He presently is a plan holder of a registered retirement savings plan (RRSP). He is considering changing his RRSP to a registered retirement income fund (RRIF).

Which of the following statements is CORRECT?

BUG Inc. has a beta of 1.65. If the market drops by 18.48% over the next 12 months, by approximately how much could BUG Inc. shares fall over that time period?

What party is responsible for ensuring that a public corporation's total number of outstanding common shares does not exceed its total number of authorized shares?

Karen’s know your client (KYC) profile corresponds to someone who has a long time horizon, is comfortable with risk and volatility, and is primarily interested in growth. She watches the daily movements of the Toronto Stock Exchange (TSX) and wants a mutual fund that will closely match what she sees.

What kind of mutual fund would be BEST for her?

What allocation strategy does an investment advisor apply when adjusting risk and return levels according to behavioural tendencies?

The Canadian Investor Protection Fund provides what amount of maximum protection for eligible customer losses due to a dealer member’s insolvency?

Which of the following CORRECTLY describes a material conflict of interest that has been properly addressed by the Dealing Representative?

Over the course of a couple of weeks and several appointments, Harold was finally able to provide an investment solution for his new client, Felicia. It was a lump sum investment where they plan to see her

money grow for the next 5 years.

With regards to Know Your Client (KYC) requirements, what are Harold's responsibilities moving forward?

Marc asks his new client for copies of his mortgage documents. Which Know Your Client component is Marc researching?

If an investor was looking for an investment with a risk equal to that of the market, which factor would she want in an investment?

Which investment securities will change value depending on the price change in the underlying assets?

Catarina is a Dealing Representative for Ethical Financial which represents 20 different mutual fund families. Darlene is a fund manager from one of those mutual fund families and wants to send a gift card to Catarina as a symbol of appreciation. Ethical Financial's policies and procedures manual (PPM) require that Catarina decline the gift.

What method of addressing conflict of interest is being used by Ethical Financial?

Maalik opens an account for a new client, John. During the new account process, Maalik determines that he will need to confirm John’s identity. Which of the following statements about Maalik’s identification requirements is CORRECT?

You are meeting a new client, Steven, and you are trying to determine his level of understanding of different investments. Which question would give you the most information regarding your client's familiarity with investing?

Gregory is a conservative investor who wants to hold a portfolio of equity securities that would fall less than the overall market in a downturn.

Which of the following portfolios would you advise Gregory to invest in?

If the Consumer Price Index (CPI) was 140.6 last year and 146.9 this year, what was the inflation rate over the year?

One of your clients, Harry, has heard that he can defer paying tax on capital gains. He wants to know if what he has heard is correct and if so, how to defer paying taxes on capital gains.

What would you tell Harry?

What type of GIC would be most appropriate for an investor who believes equity markets will be strong in the next five years?

Every February, Reginald, a Dealing Representative, feels pressured by his Manager to generate new registered retirement savings plans (RRSP) and contributions to assist the branch in meeting broader business targets. Reginald is nearing the end of February, and he has a meeting with a new client, Orel. Orel wants to open a tax-free savings account (TFSA) to develop emergency savings because he does not want to worry about his withdrawals being taxed. Reginald suggests that if Orel were to contribute to an RRSP first, then the resulting tax savings could be used to fund a new emergency account.

In relation to account suitability, what can be said about Reginald’s advice?

How is a $10,000 withdrawal from a registered retirement savings plan (RRSP) taxed?

Patrick is a portfolio manager for the HyperTally Growth Fund. It has generated an annualized rate of return of 10% this past year. However, with the anticipation of very high inflation to soon occur, there is also an expectation of higher interest rates. Patrick is concerned about the future returns of existing stocks within the fund. What may Patrick do to protect against the market value of the fund dropping?

Karen works Monday to Wednesday for a member of the MFDA as a dealing representative and Thursday and Friday as a language instructor at a local college. Client orders received on Thursdays and Fridays are held until Karen returns to work the following week. What condition of dual employment is violated under these circumstances?

The owners of Underground Airways Ltd. want to take their privately owned corporation public through an initial public offering (IPO). They are speaking to a specialist from an investment dealer to determine

whether it would be advisable to become listed on a stock exchange or the over-the-counter (OTC) market.

In comparing the two options, which of the following considerations is TRUE?

Throughout the year, the Redwood Global Equity Fund generated the following outcomes:

. $1.00 per unit of interest income from Canadian treasury bills

. $2.50 per unit of dividend income from foreign corporations

. $7.75 per unit of capital gains from the sale of Canadian corporations

. $6.50 per unit of capital gains from the sale of foreign corporations

. $2.00 per unit of capital losses from the sale of foreign corporations

Given that the Redwood Global Equity Fund is structured as a mutual fund trust, which of the following statements is true?

Malik has been saving money for retirement but he is worried about the impact inflation may have on the value of his savings. He wants to purchase a bond that will give him a steady stream of income that is greater than the inflation rate. He has found a bond issued by a major airline with a market price of $9,200, a par value of $10,000, and a coupon rate of 6.75%. What is the current yield of this bond?

Xerxes, 45 years old, is a successful architect, having an annual income of $185,000. He has around $10,000 in his non-registered account, which he is looking to invest in a tax-efficient manner.

From the following options, which would be the most tax-efficient?

Which factor is most important to consider when selecting a principal protected note (PPN)?

You are meeting a potential client, William, for the first time. He is a high net worth individual and you are keen to get his business. Which of the following would you consider the most important to create an impressive first impression on your potential client?

All other factors being equal, which fund outperformed the benchmark during this period? The benchmark return is 4.75%.

Fund

Starting NAV ($)

Ending NAV ($)

ABC

21.15

22.09

FED

25.37

26.61

MCQ

30.14

31.55

XYZ

31.00

31.99

Ken is a member of his employer’s Defined Benefit Pension Plan (DBPP). Which of the following statements about Ken’s plan is CORRECT?

Francis wants to redeem his US Asset Allocation Fund as he needs the money for a down payment for a home purchase. The current proceeds from the redemption are USD $27,859, and the current CAD/USD exchange rate is 0.7353.

How much will Francis receive in Canadian dollars when he redeems the Funds? Please round your answer to the nearest dollar.

Terri, 30 years old, is the marketing manager at Provincial Winery with an average annual income of $60,000. Her spouse Yvette, 28 years old, is a project manager with a telecommunications firm earning

$70,000 per year. You are helping them to organize their investments and are trying to assess their financial resources.

Which of the following is the best question to ask?

The Optima Equity Fund has a beta of 1.4. What is the most accurate way to describe the Optima Equity Fund’s relationship to the market as a whole?

The following information is available for Monique:

Number of children

1

Lifetime RESP contributions to date

$45,000

CESG received to date

$7,200

Family income

$120,000

Desired current year contribution

$7,000

What is the maximum RESP contribution that Monique can make this year?

What bias results in investors valuing an asset that they own over an asset that another individual owns?

Tony, the investment manager of True North Canadian Equity Fund is deciding on some new investments. He has done an economic analysis of the various provinces and sectors of the Canadian economy and has determined that Nova Scotia and Alberta present the best prospects. He has also identified potential in the oil and gas sector. He narrows down his selection to an oil supply firm in Medicine Hat and a drilling company in Halifax.

What investment approach is Tony employing?

A portfolio that incurs a substantial loss due to a significant downturn in Canadian equities has been exposed to what type of risk?

As a measurement of risk, which of the following statements about beta is TRUE?

Ayra believes the Canadian economy will be booming for the next five years. Which mutual fund can provide Ayra with the most tax efficiency if she keeps her investment in a non-registered account?

Gary chooses not to recommend that his client sell a current mutual fund to purchase a similar new mutual fund despite pressure to meet a sales target for the new fund. What responsibility applies to Gary’s action?

An investor, whose marginal tax rate is 29%, owns non-registered units of a fund that have a beginning and ending NAVPS of $21.50 and $25.50, respectively. The inflation rate is 2%. Assuming dividends are reinvested and ignoring additions or withdrawals, what is the before-tax, one-year rate of return?

What bias would influence an investor’s decision to continue to hold an unprofitable investment despite little likelihood of an improvement in the investment’s value?

Your client, Kimberly has investments in both registered and non-registered plans. Which of the following investment strategies is best suited for Kimberly from a tax perspective?

Last year, the return on YXY fund was 10.5%. It reported a standard deviation and beta of 6.5% and 1.9, respectively. Over the same period, Treasury bills and 15-year government bonds yielded 2.2% and 4.3%, respectively. What is the fund's Sharpe ratio?

What is the best risk assessment of a portfolio composed only of dividend-paying Canadian chartered bank stocks?

In conjunction with investment objectives, what Know Your Client information is essential to allow an advisor to fulfill suitability assessment obligations?

Yesterday, Mariana purchased mutual funds for the first time from Diablo, who is a Dealing Representative for Horizon Financial. When Mariana mentions to her friend Marcus that she just started to invest, Marcus confides that he experienced losses from mutual fund investing. Her initial feelings of excitement have now changed to worry and regret. She wished she had talked to her friend before investing and wonders if she can change her mind.

Which statement regarding the right of withdrawal applies?

What purpose does it serve for non-money market mutual funds to hold money market instruments?

Manuel is a Dealing Representative for Commonwealth Financial Inc., a mutual fund dealer. His dealer represents many different mutual fund families available, including their own: CF Group of Funds. He is

considering recommending a CF equity fund to one of his clients, Stefania. While describing details about the fund, he informs her that accounts are set-up in nominee name, and that their mutual funds are not transferable. In addition, the fund does pay trailer fees.

What type of information has Manuel described about his potential investment recommendation?

What type of fee does a mutual fund sponsor often reduce the longer an investor holds a back-end load fund?

Which exchange in Canada deals exclusively with financial and equity futures and options?

What is the most substantial reward for providing excellent customer service as a mutual fund sales representative?

Which index would investors use as a benchmark for doing research on the largest listed public companies in the US marketplace?

When reviewing a company's balance sheets, what ratio best determines whether their borrowing is excessive?