Certified Credit Research Analyst Level 2

Last Update Feb 7, 2026

Total Questions : 84

Why Choose ClapGeek

Try a free demo of our AIWMI CCRA-L2 PDF and practice exam software before the purchase to get a closer look at practice questions and answers.

We provide up to 3 months of free after-purchase updates so that you get AIWMI CCRA-L2 practice questions of today and not yesterday.

We have a long list of satisfied customers from multiple countries. Our AIWMI CCRA-L2 practice questions will certainly assist you to get passing marks on the first attempt.

ClapGeek offers AIWMI CCRA-L2 PDF questions, web-based and desktop practice tests that are consistently updated.

ClapGeek has a support team to answer your queries 24/7. Contact us if you face login issues, payment and download issues. We will entertain you as soon as possible.

Thousands of customers passed the AIWMI Designing AIWMI Azure Infrastructure Solutions exam by using our product. We ensure that upon using our exam products, you are satisfied.

Customers Passed

AIWMI CCRA-L2

Average Score In Real

Exam At Testing Centre

Questions came word by

word from this dump

Satish Dhawan, a veteran fixed income trader is conducting interviews for the post of a junior fixed income trader. He interviewed four candidates Adam, Balkrishnan, Catherine and Deepak and following are the answers to his questions.

Question 1: Tell something about Option Adjusted Spread

Adam: OAS is applicable only to bond which do not have any options attached to it. It is for the plain bonds.

Balkishna: In bonds with embedded options, AS reflects not only the credit risk but also reflects prepayment risk over and above the benchmark.Catherine: Sincespreads are calculated to know the level of credit risk in the bound, OAS is difference between in the Z spread and price of a call option for a callable bond.

Deepark: For callable bond OAS will be lower than Z Spread.

Question 2: This is a spread that must be added to the benchmark zero rate curve in a parallel shift so that the sum of the risky bond’s discounted cash flows equals its current market price. Which Spread I am talking about?

Adam: Z Spread

Balkrishna: Nominal Spread

Catherine: Option Adjusted Spread

Deepark: Asset Swap Spread

Question 3: What do you know about Interpolated spread and yield spread?

Adam: Yield spread is the difference between the YTM of a risky bond and the YTM of an on-the-run treasury benchmark bond whose maturity is closest, but not identical to that of risky bond. Interpolated spread is the spread between the YTM of risky bond and the YTM of same maturity treasury benchmark, which is interpolated from the two nearest on-the-run treasury securities.

Balkrishna: Interpolated spread is preferred to yield spread because the latter has the maturity mismatch, which leads to error if the yield curve is not flat and the benchmark security changes over time, leading to inconsistency.

Catherine: Interpolated spread takes account the shape of the benchmark yield curve and therefore better than yield spread.

Deepak: Both Interpolated Spread and Yield Spread rely on YTM which suffers from drawbacks and inconsistencies such as the assumption of flat yield curve and reinvestment at YTM itself.

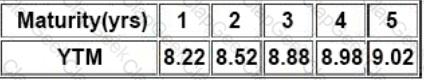

Then Satish gave following information related to the benchmark YTMs:

An investor decides to invest in the bond futures and has an outlook that the term structure curve would steepen. What should be his trading strategy?

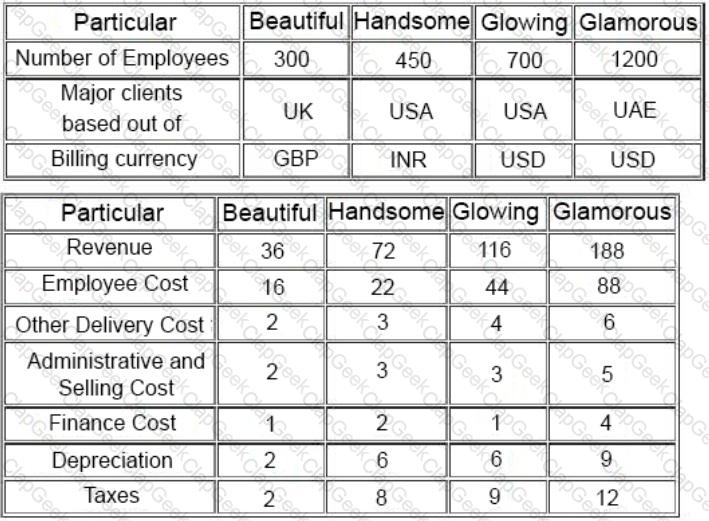

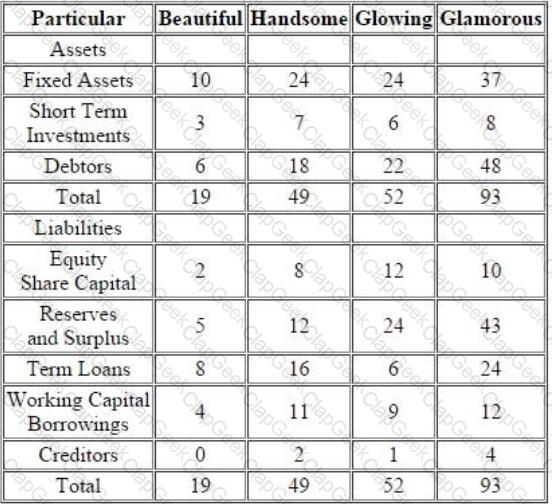

“Following four entities operate in the Indian IT and BPO space. They all are into same segment of providing off-shore analytical services. They all operate on the labour cost-arbitrage in India and the countries of their clients. Following information pertains for the year ended March 31, 2013.

The year FY13, was typically a good year for Indian IT companies. For FY14, the economic analysts have given following predictions about the IT Industry:

A) It is expected that INR will appreciate sharply against other USD.

B) Given high inflation and attrition in IT Industry in India, the wages of IT sector employees will increase more sharply than Inflation and general wage rise in country.

C) US Congress will be passing a bill which restricts the outsourcing to third world countries like India.While analyzing the four entities, you come across following findings related to Glowing:

Glowing is promoted by Mr.M R Bhutta, who has earlier promoted two other business ventures, He started with ABC Entertainment Ltd in 1996 and was promoter and MD of the company. ABC was a listed entity and its share price had sharp movements at the time of stock market scam in late 1990s. In 1999, Mr.Bhutta sold his entire stake and resigned from the post of MD. The stock price declined by about 90% in coming days and has never recovered. Later on in 2003, Mr.Bhutta again promoted a new business, Klear Publications Ltd (KCL) an in the business of magazine publication. The entity had come out with a successful IPO and raised money from public. Thereafter it ran into troubles and reported losses. In 2009, Mr.Bhutta went on to exit this business as well by selling stake to other promoter(s). There have been reports in both instances with allegations that promoters have siphoned off money from listed entities to other group entities, however, nothing has been proved in any court.”

Based solely on Total Debt to EBITDA and Interest Coverage, which of the four entities is best amongst the four respectively:

Which of the following is not one of the C in the 5 C Model?