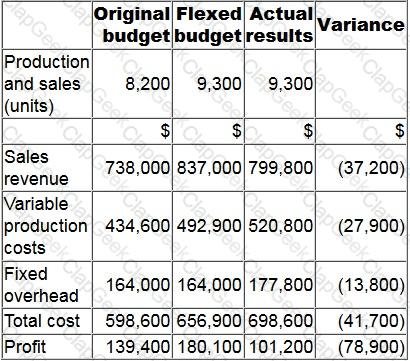

The budgetary control report of XYZ for the latest period is shown below. Variances in brackets are adverse.

What is the sales volume profit variance?

RFT, an engineering company, has been asked to provide a quotation for a contract to build a new engine. The potential customer is not a current customer of RFT, but the directors of RFT are keen to try and win the contract as they believe that this may lead to more contracts in the future. As a result, they intend pricing the contract using relevant costs. The following information has been obtained from a two-hour meeting that the Production Director of RFT had with the potential customer. The Production Director is paid an annual salary equivalent to $1,200 per 8-hour day. 110 square meters of material A will be required. This is a material that is regularly used by RFT and there are 200 square meters currently in inventory. These were bought at a cost of $12 per square meter. They have a resale value of $10.50 per square meter and their current replacement cost is $12.50 per square meter. 30 liters of material B will be required. This material will have to be purchased for the contract because it is not otherwise used by RFT. The minimum order quantity from the supplier is 40 liters at a cost of $9 per liter. RFT does not expect to have any use for any of this material that remains after this contract is completed. 60 components will be required. These will be purchased from HY. The purchase price is $50 per component. A total of 235 direct labour hours will be required. The current wage rate for the appropriate grade of direct labour is $11 per hour. Currently RFT has 75 direct labour hours of spare capacity at this grade that is being paid under a guaranteed wage agreement. The additional hours would need to be obtained by either (i) overtime at a total cost of $14 per hour; or (ii) recruiting temporary staff at a cost of $12 per hour. However, if temporary staff are used they will not be as experienced as RFT’s existing workers and will require 10 hours supervision by an existing supervisor who would be paid overtime at a cost of $18 per hour for this work. 25 machine hours will be required. The machine to be used is already leased for a weekly leasing cost of $600. It has a capacity of 40 hours per week. The machine has sufficient available capacity for the contract to be completed. The variable running cost of the machine is $7 per hour. The company absorbs its fixed overhead costs using an absorption rate of $20 per direct labour hour.

Select ALL the true statements.

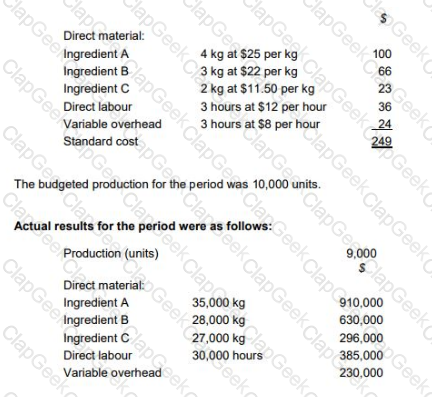

TP makes wedding cakes that are sold to specialist retail outlets which decorate the cakes according to the customers’ specific requirements. The standard cost per unit of its most popular cake is as follows:

The general market prices at the time of purchase for Ingredient A and Ingredient B were $23 per kg and $20 per kg respectively. TP operates a JIT purchasing system for ingredients and a JIT production system; therefore, there was no inventory during the period.

What was the material price planning variance for ingredient B?

State whether the following costs are relevant or non-relevant in the context of short-term decision making scenarios.

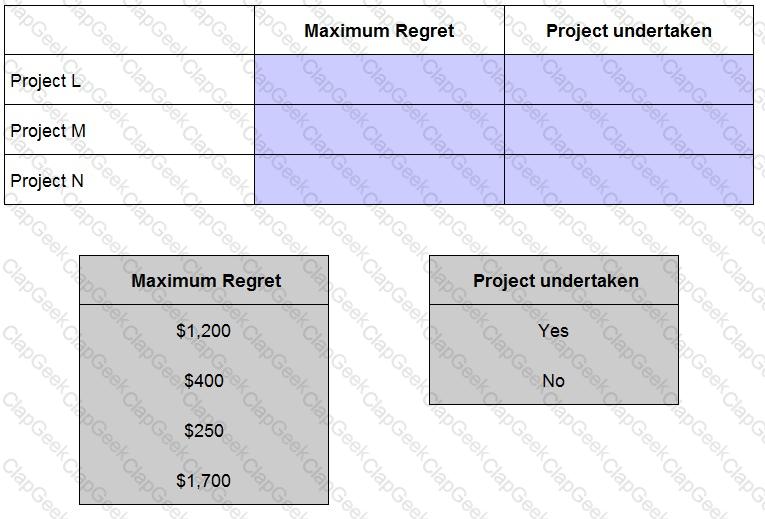

A company is choosing between three projects, Project L, Project M and Project N using minimax regret. The outcome from each project is dependent on competitor reaction. If this is passive returns will be L $4,000, M $3,500 and N $5,200. If it is aggressive returns will be L $3,200, M $2,800 and N $2,950. Place the tokens into the table to show the maximum regret for each project and whether the project would be undertaken using minimax regret.

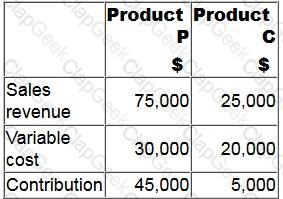

An entity manufactures two products.

The sales revenues of the products are in the constant mix of 3:1. Forecast data for next period are as follows:

The margin of safety for next period is $30,000 of sales revenue. Fixed costs are constant at all levels of output.

What is the forecast profit for next period?

Give your answer to the nearest whole number.

Company NBO is providing a quote to manufacture 500 passenger seats for a bus company.

Relevant cost is being used as the basis for the quote.

Which THREE of the following should be included as relevant costs or savings in the production of the 500 passenger seats?

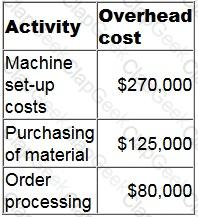

PQR has recently introduced an activity-based costing system.

It manufactures three products, details of which are given below.

The budgeted production overhead costs for the year are shown in table below:

What is budgeted machine set-up cost per unit of Product J?

Give your answer to the nearest cent.

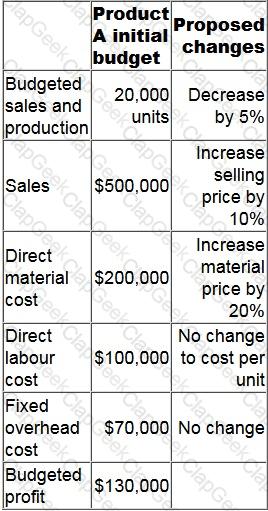

Company M is preparing its budgeted profit statement for the next year.

The initial budget for Product A is as follows with some changes proposed by the sales director to increase the quality of the product.

What would the budgeted profit of Product A be if the proposed changes are made?

Give your answer as a whole number.

The standard output from a joint process is 4,000 litres of Product K, 6,000 litres of Product L and 3,000 litres of Product M.

The total cost of the joint process is $147,000.

The company is now deciding if it should further process Product L.

In the further processing decision the best way to apportion the joint costs to the products is:

A company manufactures a single product and absorbs fixed production overheads at a predetermined rate based on budgeted expenditure and budgeted units.

Which TWO of the following would definitely lead to an over absorption of fixed production overheads?

Traditional absorption costing is more suitable than activity-based costing when:

You are a management accounting working for a car manufacturer. The company is publicly listed and has been around for many years.

The company produces 2 products. Car 1 and Car 2. Car 1 sells for £20,000 and Car 2 for £27,000.

Car 1 can be upgraded post production to the 1ZC model for £5,000 and Car 2 to the 2ZC model for £3,500.

Post production upgrade the 1ZC sells for £25,500 and the 2ZCfor £30,000.

The company sources all of its supplies for the same supplier and has access to a large workforce. As a result there are no bottlenecks or limiting factors to production.

Based on the information above the company should...

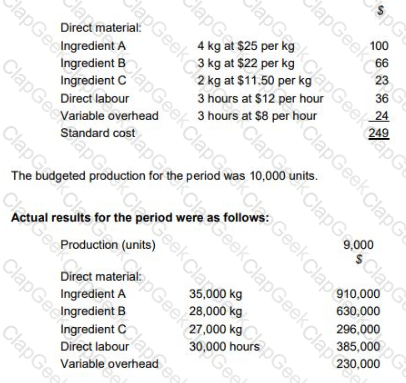

TP makes wedding cakes that are sold to specialist retail outlets which decorate the cakes according to the customers’ specific requirements. The standard cost per unit of its most popular cake is as follows:

The general market prices at the time of purchase for Ingredient A and Ingredient B were $23 per kg and $20 per kg respectively. TP operates a JIT purchasing system for ingredients and a JIT production system; therefore, there was no inventory during the period.

Discuss the usefulness of the planning and operational variances calculated for TP’s management.

Select ALL the TRUE statements.

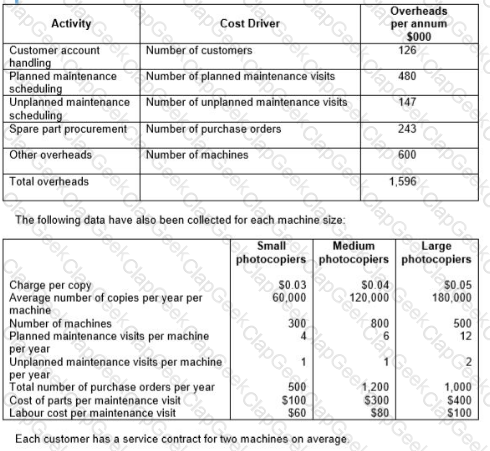

A company sells and services photocopying machines. Its sales department sells the machines and consumables, including ink and paper, and its service department provides an after sales service to its customers. The after sales service includes planned maintenance of the machine and repairs in the event of a machine breakdown. Service department customers are charged an amount per copy that differs depending on the size of the machine.

The company’s existing costing system uses a single overhead rate, based on total sales revenue from copy charges, to charge the cost of the Service Department’s support activities to each size of machine. The Service Manager has suggested that the copy charge should more accurately reflect the costs involved. The company’s accountant has decided to implement an activity-based costing system and has obtained the following information about the support activities of the service department:

Calculate the annual profit per machine for each of the three sizes of machine using activity-based costing.

Which of the following statements about total quality management are incorrect? Select ALL that apply.

A company's initial budget for month 3 includes sales of $100,000, a contribution to sales (C/S) ratio of 40% and fixed costs of $20,000.

If the budgeted sales volume in month 3 is reduced by 5% but contribution per unit, total fixed costs and sales mix are unchanged, which of the following statements, about the change to the budgeted profit or contribution in month 3 is true?

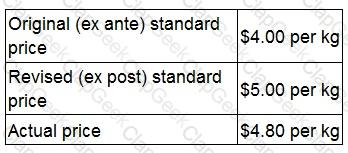

A company reports planning and operational variances to its managers. The following data are available concerning the price of direct material M in the last period. Material M is the only material used by the company. The company operates a just-in-time (JIT) purchasing system.

Which TWO of the following statements about last period are definitely correct based on this information?

The direct material price operational variance was adverse.

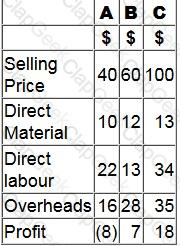

A company makes and sells three products A, B and C.

The selling prices and costs of the three products, using a traditional absoprtion costing system, are shown in the table below.

The company has undertaken an analysis of overhead costs using activity-based costing (ABC).

The revised overhead costs for products A, B and C are $6, $32 and $55 respectively.

When comparing the figures obtained under the two costing methods, which of the following statements are true?

Select ALL that apply.

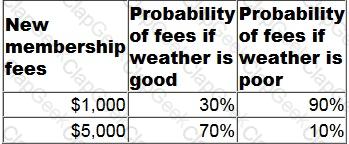

A tennis club is considering running an open day to encourage new members and thus increase membership fees. The cost of the open day will be $1,000. Attendance is dependent on the weather. There is a 60% chance of good weather and a 40% chance of poor weather on the open day.

The expected new membership fees are:

What is the expected value of running the open day?

Give your answer as a whole number.

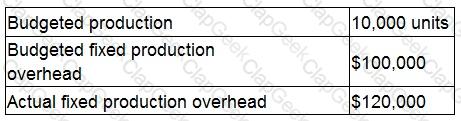

A company manufactures a single product. The company absorbs fixed production overhead using a pre-determined rate per unit.

The following data applies for month 7:

During month 7 fixed production overhead was over absorbed by $40,000.

What was the actual number of units produced during month 7?

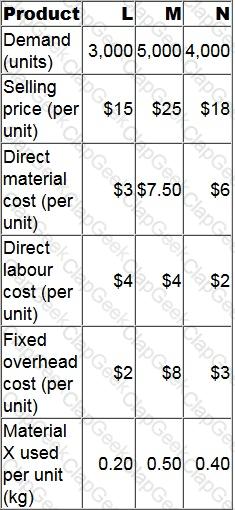

FG Enterprises manufactures and sells three products. There are 4,400 kg of Material X available in the next period. Material X is used in the manufacture of all three products. The following data is available for the next period.

What is the optimal production plan for the next period in order to maximise profit?

A decision tree is being evaluated back to a decision point.

There are two alternatives at this point:

1. To abandon the project and generate a return of $435,000;

2. To continue with the project and generate the following possible returns:

What value should be included at the decision point?

A time series (TS) is made up of two main components i.e. trend (T) and the seasonal variation (SV).

Which TWO of the following could be used to find the seasonal component of a trend?

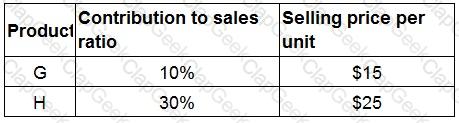

Information about a company's two products is as follows:

The products are currently sold in equal quantities.

Monthly fixed costs are $360,000.

What is the monthly breakeven sales revenue assuming a sales quantity mix of 50/50?

Give your answer to the nearest $.

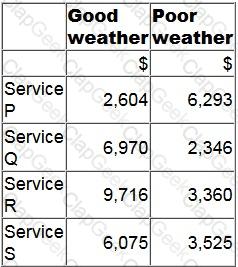

A manager is deciding which one of four services to provide next period.

The contribution earned by each service will depend on the weather conditions as follows.

Using the maximin criterion, which service will the manager provide?

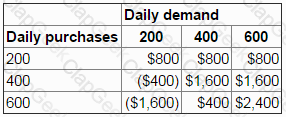

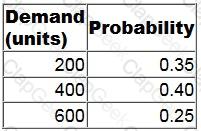

The daily demand for a perishable product has the following probability distribution:

Each unit of the product costs $6 and is sold for $10.

Unsold items are thrown away at the end of the day.

Orders must be placed each morning before the daily demand is known.

The payoff table below shows the profit that would be earned for each of the combinations of purchases and demand.

The number of units that should be purchased at the beginning of each day in order to maximize expected profit is:

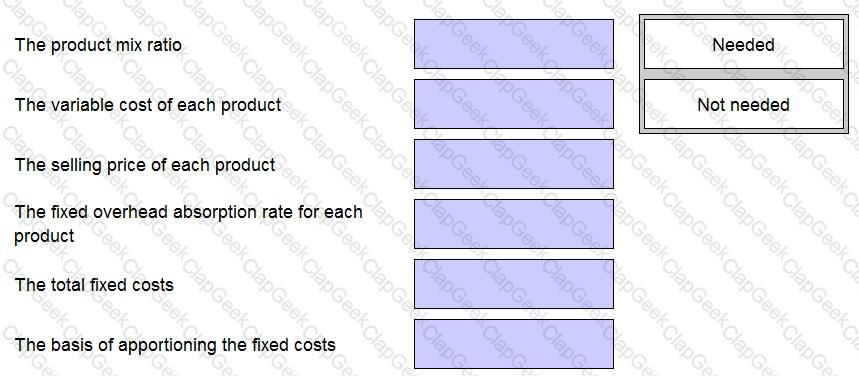

A manufacturing company sells 5 different products.

The company holds no inventories and has a high level of fixed cost.

Place against the statements below the comment "needed" or "not needed" to select ALL of the information required to calcuate the total number of units to break-even.

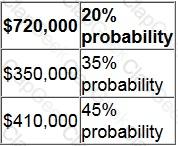

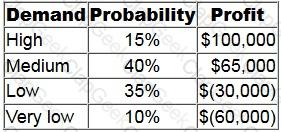

JDM is considering whether to go ahead with the launch of a new product. Profit from the new product is dependent on the level of demand.

The following table shows the estimated profits and their respective probabilities at different levels of demand.

The company could still cancel the launch of the product but would incur a cost of $7,000.

What is the maximum amount that the company should pay for perfect information about demand for the product?

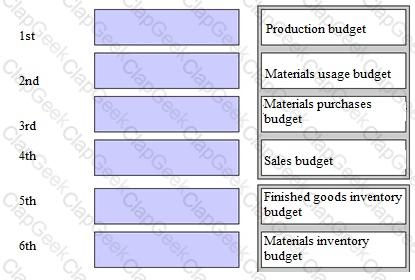

For a company that does not have any production resource limitations, what would be the correct sequence for budget preparation?

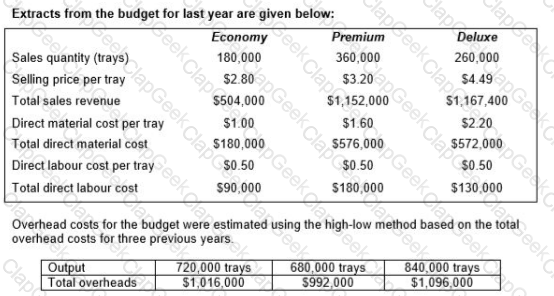

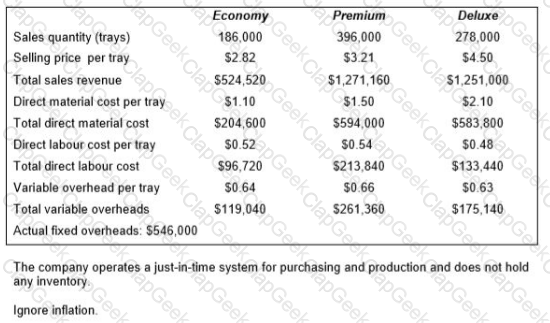

A company produces trays of pre-prepared meals that are sold to restaurants and food retailers. Three varieties of meals are sold: economy, premium and deluxe.

Calculate, for the original budget, the budgeted fixed overhead costs, the budgeted variable overhead cost per tray and the budgeted total overheads costs.

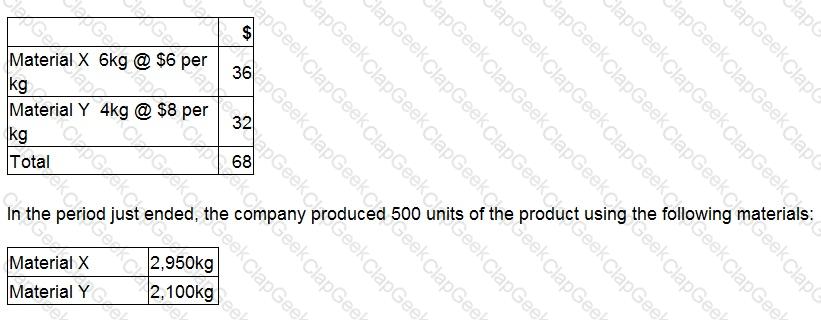

A company makes a product using two materials, X and Y.

The standard materials required for one unit of the product are:

What is the materials yield variance?

Give your answer as a whole number.

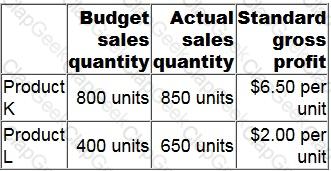

The following information is available regarding a company's two products for last period.

What is the favourable sales quantity profit variance for last period?

Give your answer to the nearest whole $.