______ holds that the exchange of currencies should be determined not by state institutions but by individuals in the market.

Mr. L Singh used machinery in his business. This is the only asset in the block. 20% of the usage is for personal purposes. The WDV of the block as on 31.3.2011 is —

Which of the following is an inferential data (i.e. data which may not be correctly obtained by simply asking a direct question)?

Which of the following statement best describes the Cash Flow Planning Process?

Ramesh living in Kolkata is a trustee for Brijesh living in Mumbai, Ramesh remits trust funds to Brijesh by bills drawn by a person of high creditworthiness in favor of the trustee as such and payable at Mumbai. The bills later got dishonored. Is Ramesh bound to make good the loss?

Accrued Interest on loan for self occupied property is Rs.110000 till 31 March 2010. Loan was taken for construction on 31/07/2006 and construction completed on 03/04/10. Interest for the year 2010-11 is Rs 22000. Determine what interest shall be allowed u/s 24(b) for AY 2011-12

In case of an individual and HUF cash in hand in excess of …………… shall be included in assets

Jignesh is 23 years old and plans to retire at 60. His life expectancy is 70 years. You being his CWM® estimate that his client will require Rs. 40,000/- in the first month after retirement. Inflation rate is 5% p.a. and the rate of return is 7% p.a. Currently Jignesh has investment of Rs. 50,000/- @ 7% rate of interest. What will be the extra savings per month at begin required in order to achieve this?

The difference between aggregate disbursements net of debt repayments and recovery of loans and revenue receipts and non debt capital receipts is called:

Calculate premium payable for term insurance policy of Rs. 10 lacs, for a group of 278 people of 39 years of age. The Mortality Table shows that in this age group 2,681 people die every year in a group of 12,50,000.

The beta of stock of Akhil Computers Ltd., is 1.5 and is currently in equilibrium. The required return on the stock is 19% and the expected return on the market is 15%. Suddenly due to a change in economic conditions, the expected return on the market increases to 17%. Other things remaining the same what would be new required rate of return on the stock?

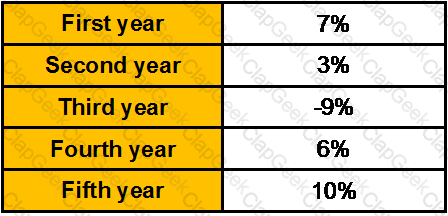

Returns on a security held for 5 years by Praveen are:

Find the standard deviation of the security.

Ramesh has invested Rs. 70,000, 30% of which is invested in Company A, which has an expected rate of return of 15%, and 70% of which is invested in Company B, with an expected return of 12%. What is the expected percentage rate of return?

Dharampal has let out his house property at monthly rate of Rs. 12000. He has paid Rs.3500 as annual municipal tax. He wants to know the Net Annual value of his house at Bhuj for AY 2011-12. The Municipal value of the house is Rs. 90,000, Fair rent Rs. 1,40,000, Standard rent Rs. 1,20,000. The house was vacant for one month during the previous year 2010-11 and the rent has not changed since then.

A money back policy for SA of Rs. 100000/-. Matured after 25 years. Survival benefits of 15% each has been paid at the end of 5th , 10th, 15th, and 20th years. Bonus has accrued at Rs. 965/- per Rs. 1000 SA. Interim bonus @ Rs. 25/- per thousand SA is payable. What is the maturity claim amount?

Mr. Bharat sees a stock with a beta of 1.2 selling for Rs. 25 and price will move up to Rs. 31 by the end of the year. The risk free rate is 6% and the expected market return is 15 %. In this scenario Mr. Bharat would like to know whether the stock is _____________ and so should ___________.

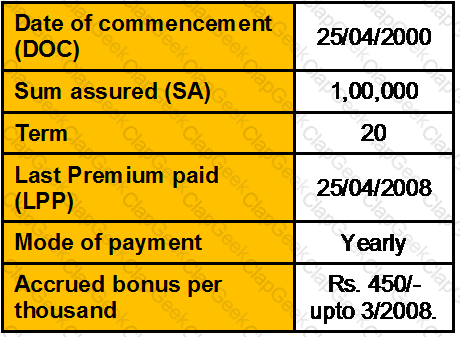

From the following information:

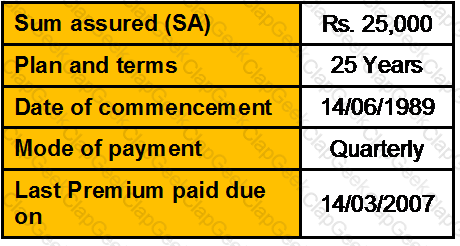

The Surrender value is 43% of the paid up value and loan is available at 85% of surrender value.

Calculate paid up value, surrender value, and loan value

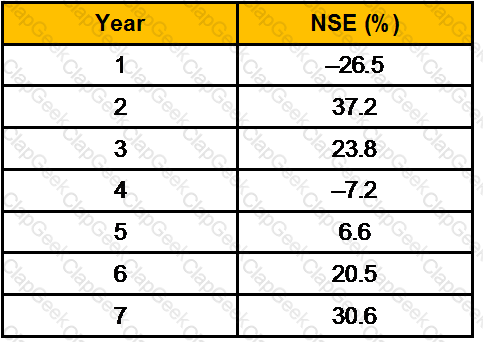

You are given the following set of data:

Historical Rate of Return

Determine the arithmetic average rates of return and standard deviation of returns of the NSE over the period given.

A Post Office Recurring Deposit account can be prematurely closed after _______ years and ________ interest would be payable on prematurely closed account.

Spot Nifty is at 5000. One month Nifty call with strike price of Rs. 4800 is trading at Rs. 250 per call. An investor buys 100 Nifty calls. At expiry Nifty closes at 5500. Net profit / loss of the investor is Rs. ___.

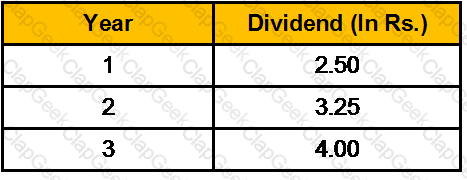

The management of Pearls India Shopping Ltd has recently announced that expected dividends for the next three years will be as follows:

For the remaining years, the management expects the dividend to grow at 5% annually. If the risk-free rate is 4.30%, the return on the market is 10.30% and the firm’s beta is 1.40. What is the maximum price that you should pay for this stock?

Miss. Nidhi Gupta has sold 600 calls on DR. REDDY’S LAB at a strike price of Rs.992 for a premium of Rs.25 per call on April 1, 2007. The closing price of equity shares of DR. REDDY’S LAB is Rs.994 on that day. If the call option is assigned against her on that day, what is her net pay off?

Azhar aged 30 is a disciplined investor. He has started depositing Rs. 25,000 every year in an account that pays a return of 9% every year. He plans to increase his contribution by Rs. 5000 every year till his age 50. Calculate the amount he would be having in his account at this age.?

Mahesh earns 1,20,000 pa. He has total debt of Rs. 2,00,000 and have two dependants. Interest rate is 7%, and assumes 80% of his pre-death salary is the estimated requirement to maintain his family after paying the loan. Calculate the life insurance cover needed under multiple approach method.

You are considering investing in a following bond:

Your income tax rate is 34 percent and your capital gains tax is effectively 10 percent. Capital gains taxes are paid at the time of maturity on the difference between the purchase price and par value. What is your post-tax approximate yield to maturity on this bond?

Mr. Kadam is entitled to a salary of Rs. 25000 per month. He is given an option by his employer either to take house rent allowance or a rent free accommodation which is owned by the company. The HRA amount payable was Rs. 5000 per month. The rent for the hired accommodation was Rs. 6000 per month at New Delhi. Advice Mr. Kadam whether it would be beneficial for him to avail HRA or Rent Free Accommodation. Give your advice on the basis of “Net Take Home Cash benefits”.

An individual has recently purchased a house worth Rs. 40 lakh for self-occupation by availing housing loan of Rs. 28 lakh at 9.25% p.a. rate of interest. The tenure of loan is 18 years. He has Rs. 12 lakh financial assets at present. He is expected to save annually Rs. 2 lakh which he invests on a quarterly basis beginning a quarter from now in an instrument which is expected to provide return of 9% p.a. What would be his net worth five years from now? The value of the house which is for consumption purposes is not considered in the net worth so arrived.

Mr. M is an employee of Z Ltd. His basic pay is Rs.24,000 p.a., Dearness Allowance Rs.12,000 p.a; Medical Allowance (fixed) Rs.10,000 p.a.; Conveyance Allowance Rs.6,000 p.a.; Professional Tax deducted from his salary Rs.1,000 p.a.; Free lunch provided during office hours valued at Rs.12,000 for a 300-working day year; free education for two children in a school owned and maintained by the employer – school tuition fee for both the children is estimated at Rs.18,000 p.a.

What is Net Income of Mr. M and examine whether he is a specified or non-specified employee?

Mohan is a manager in ABC Co. Ltd. His family consists of his wife and child. It is assumed that his family needs a minimum of Rs. 10,000 per month to maintain current standard of life in unfortunate case of demise of Mohan. The interest rate is 6% pa. Calculate how much insurance is required under income replacement method?

Pushkar completed the construction of a house property on 14.8.2008 with borrowed capital of Rs.800000 @ 12%. The loan was taken on 1.4.2006 and is still outstanding. The house was used for his own residence during the entire FY 10-11. Deduction U/S 24(B) for interest on borrowed capital for FY shall be

The correlation coefficient between returns on stock of M/s X Ltd and the market returns is 0.3. The variance of returns on M/s X Ltd. is 225(%)2 and that for the market returns is 100(%)2 . The risk-free rate of return is 5% and the market return is 15%. The last paid dividend is Rs. 2 and the current purchase price is Rs. 30. The growth rate for the company is 10%. The required rate of return on the security as per the Capital Asset Pricing Model is:

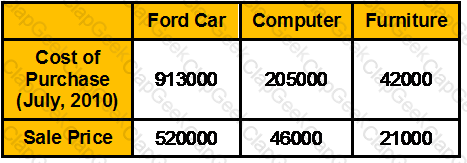

Find out the taxable value of perquisite from the following particulars in case of an employee to whom the following assets held by the company were sold on 1.8.2012.

The assets were put to use by the company from the day they were purchased.

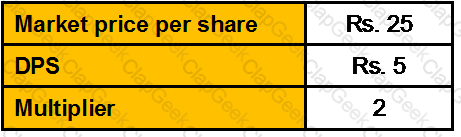

The following information regarding the equity shares of M/s V Ltd. is given

Calculate the EPS of M/s V Ltd. according to the traditional approach

"Consider the following information for three stocks, Stock A, Stock B, and Stock C. The returns on each of the three stocks are positively correlated, but they are not perfectly correlated.

Portfolio X has half of its funds invested in Stock A and half invested in Stock B. Portfolio Y has invested its funds equally in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium.

Which of the following statements is/are correct?

Ankur Kalra is 33 years old finance professional. The house hold expenditure of Mr. Kalra is 20,000/- p.m. to maintain his current living standard. He assumes that his living standard will increase 1.5% annually until his retirement at 60. His life expectancy is 70 years. At retirement he needs 75% of his last year’s expenses. Inflation rate for the next 45 years is expected to be 4% p.a.

Calculate how much would Mr. Kalra require in the first year after his retirement, and how much he has to save at end of every year to accumulate this corpus, if the return on investment is 7% p.a.?

"During the PY 2009-10 a Poonawala Charitable Trust earned an income of Rs. 7 lakh out of which Rs.5 lakh was received during the PY 2009-10 and the balance Rs. 2 lakh was received during the PY 2011-2012.In order to claim full exemption of Rs. 7 lakh in the PY 2009-10:

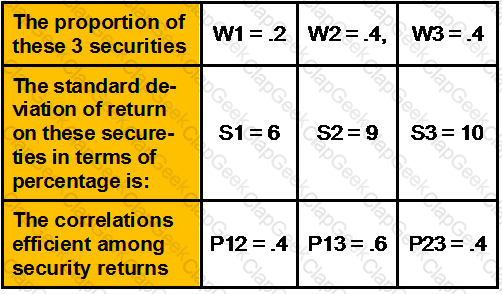

A portfolio consists of 3 securities.

What is the standard deviation of the portfolio?

Mr.Rajesh ,35 years old sole business consultant of “Oriental Décor Import”California , USA. He arranges Indian Handicraft Products in India as per “Oriental Décor Import” orders. He earns 5% commission on goods purchased by “Oriental Décor Import”. The “Oriental Décor Import” has invited him in USA for inauguration of their 21 chain stores In USA and Europe and he has to expect to say long for providing Indian Handicraft Product Training to all staffs of the Company working in different chain stores. As a Chartered Wealth Manager he comes to you to plan his journey in such a manner so that he can get maximum tax benefits in the assessment Year 2010–11 from the residential status point of view. In the year 2008–09 was present in India only 80 days. What is the latest date when he can afford to leave India to get maximum tax benefits in the said assessment year?

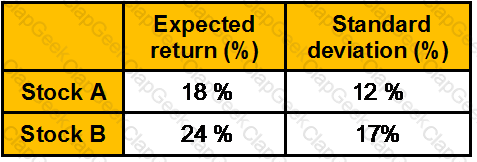

Consider two stocks, A and B

The returns on the stocks are perfectly negatively correlated.

What is the expected return of a portfolio comprising of stocks A and B when the portfolio is constructed to drive the standard deviation of portfolio return to zero?

Ramesh aged 50 could not save for his retirement till date but now decides to save Rs. 50000 per month till his retirement age of 65. He anticipates that the return in the first 5 years would be 13% p.a. next 5 years 10% and in the last 5 years 8% p.a. He wants to accumulate a corpus of Rs. 1.50 Crores till his retirement. Calculate the surplus or shortfall he would have on his retirement.

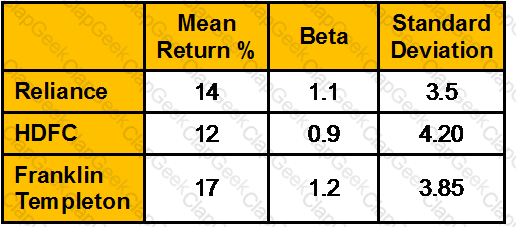

Consider the following information for three mutual funds:

Market Return 10%

Risk free return is 6%.

Calculate the Risk Adjusted Return on the basis of Jensen measure (%)?

Mr. John purchased a house in Mumbai in March 2010 for Rs.12,50,000. In April,2011 he entered into an agreement to sell the property to Mr. Akram for a consideration of Rs.19,75,000 and received earnest money of Rs. 50,000. As per the terms of the agreement, the balance payment was to be made within 30 days of the agreement. If the intending purchaser does not make the payment within 30 days, the earnest money would be forfeited. As Mr. Akram could not make the payment within the stipulated time the amount of Rs.50000 was forfeited by John. Subsequently John sold the house in June, 2011 for Rs.2130000. He paid 2% brokerage on sale of the house. Calculate the capital gains chargeable to tax for the assessment year 2012-13. [CII-12-13: 852,11-12: 785,10-11:711]

Sachin aged 35 years is married and is working as a manager in M/s Birla Mill Ltd. His most likely retirement age is 60 years. His present salary is Rs. 3,00,000/- pa. His self-maintenance expenses are 30,000/- per year. Life insurance premium paid is 15,000/-. Income tax & professional tax amount to Rs. 20000/-. Rate of interest assumed for capitalization of future income is 8%. Calculate Sachin’s HLV to recommend adequate insurance cover

During the PY 2009-10 a Kariwala Charitable Trust earned an income of Rs. 7 lakh out of which Rs.5 lakh was received during the PY 2009-10 and the balance Rs. 2 lakh was received during the PY 2011-2012.In order to claim full exemption of Rs. 7 lakh in the PY 2009-10:

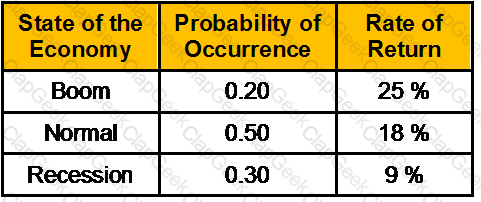

The probability distribution of the rate of return on a stock is given below:

What is the standard deviation of return?

Vinod is projecting an income stream providing Rs. 2,000/- for first 3 months, Rs. 3,200 for next 2 months, Rs. 4,500 for next 1 month, Rs. 3,700 for next 6months and Rs. 800 for 2 months thereafter. Please calculate the Present Value of this cash stream if rate of interest is 9%

Calculate the Paid up Value ( PV) under a policy with the following particulars:

Consolidated Reversionary Bonus declared by the insurer from March, 1990 to March 2006 is 550/- per thousand sum assured. Bonus declared for the year ending March 2007 is @ Rs. 70/- per thousand.

Calculate the total return on the mutual fund investment with the below mentioned information:

You wish to save for your son’s education the present cost of which is Rs. 320000 and is expected to increase by 6% every year. If your son is 12 years old and will require money in 8 years time, what is the annual amount of investment to be made if it is likely to earn 12% rate of return?

A trust which is established by expressions of confidence ,request or desire that property

will be applied for the benefit of a definite person or object is termed as:

What is the most essential characteristic to be in existence at the stage of establishing client relationship?

Mukul purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10-2006 for Rs. 25,00,000/-. Please calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

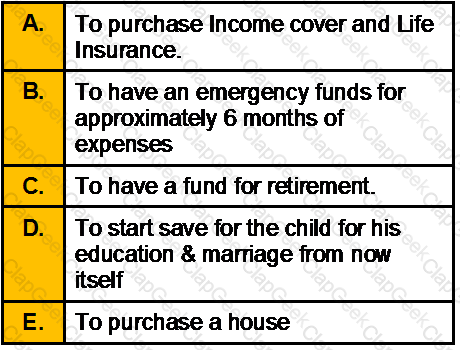

Rahul and Priyanka went to a wealth manager. Both of them have just got married. Their funds are limited and their needs are many.

Some of their needs are:

Kindly suggest the order in which they should start providing for their above needs:

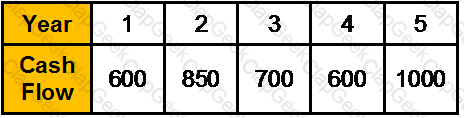

What is the present value of the following cash flows, if the Interest rate is 8%?

A Treasury bill pays a 6% rate of return. A risk averse investor __________ invest in a risky portfolio that pays 12% with a probability of 40% or 2% with a probability of 60% because __________.

As a CWM® you recommended Mr. Raj Malhotra to put his money in Asset A offering 15% annual return with a standard deviation of 10%, and balance funds in asset B offering a 9% annual return with a standard deviation of 8%. Assume the coefficient of correlation between the returns on assets A and B is 0.50. Calculate the expected return after 1 year and standard deviation of Mr. Raj Malhotra’s portfolio

Which of the following is a reasonable assumption to make about the understanding of a client on the Wealth planning Process?

The risk free return of Security A is 8%. In addition to it, you expect that the return on market would be 14%. The expected return of Security A with beta of 0.70 is ________.

Ms. Shweta wants to achieve the goal of higher education of her daughter after 15 years. She estimates that the funds required would be 30 lacs at then costs. She wants to invest monthly for this goal. You as a Wealth Manager suggest an asset allocation of 80% in Equity and 20% in Debt for 14 years and shifting the entire amount to liquid funds in the last year where the expected returns would be 6% p.a. If the returns in equity and debt funds are 14% and 8.50% respectively calculate the amount that needs to be invested in Equity and Debt Each Month.

A fraud is discovered with respect to an loan that has turned NPA. When is the earliest that it can be treated as a doubtful asset?

In ULIP plans, the returns are dependent on in which the investments are done by the insurance company

While granting a bank license, RBI considers all of the following, except ________."

If an investor is bearish on a share, buying a put is usually better then selling short because:

Where a coparcener with only his widow as legal heir dies, Can a partition be deemed as between the surviving coparcener and the widow on his death?

An insured becomes entitled for getting No Claim Bonus only at the renewal of a policy after the expiry of the full duration of _________ months.

The operatives Guidelines for Banks on Mobile Transactions in India were issued

A lease which is short term in nature usually 3 years or less ,associated with high tech equipment or property which is prone to technological obsolesence

An employee benefit plan can generally help in accomplishing all of the following items except:

The minimum amount for secured lenders to take the benefit of SARFAESI is _______.

If after the partition of an HUF 2 members became partners in 3 firms on behalf of their respective HUFs and they also become partners in a fourth firm. The funds were obtained by means of loans from the other 3 firms. The share incomes of the members from the fourth firm were assessable as their individual income only.

You are given the following set of data on security XYZ:

Calculate the expected return on security XYZ?

The Motor Vehicle Insurance Policy has inbuilt cover for death/disability of driver/owner caused by accident during the use of the insured motor vehicle up to Rs. __________ in case of car/commercial vehicle and Rs. _________ in case of two wheelers.

Ram born in 1950 has a life expectancy at birth of 65 years. Sita his wife born in 1955 has a life expectancy at birth of 70 years. Assuming that the life expectancies have not changed. Ram is planning to buy an annuity to be paid to him or his wife till anyone of them is alive. Assuming Ram will retire on attaining age 58 i.e. in 2008, what should be the time period of the annuity?

Mr. Kishan owns a factory producing some small spare parts.Under which policy he can get cover against the claim for paying damages and legal costs arising from any bodily injury or damage in the premises of his property ?

You want to have Rs. 1,000,000 when you retire in 30 years. You expect to earn 12% compounded monthly over the entire 30-year period. How much extra money per month must you deposit if you choose to fund using an ordinary annuity technique rather than an annuity due technique ?

You bought a stock for Rs. 28.29 that paid the following dividends

After the third year, you sold the stock for Rs. 35. What was the annual rate of return?

The income of any university or other educational institution existing solely for educational purposes and not for the purposes of profit is exempt under clause (iiiad) of Section 10(23C) if the aggregate annual receipts’ of such university or educational institution do not exceed.

How much should one deposit today in a bank account paying interest compounded quarterly if you wish to have Rs. 10000 at the end of 3 months, if the bank pays 5% annually?

Mayank an investor buys one share of stock for Rs.500 at the beginning of the first year, and buys another share for Rs.550 at the end of the first year. The investor earns Re.10/- in dividends in the first year and Re.20/- in the second year. What is the time-weighted rate of return if the shares are sold at the end of the second year for Rs.650/- each?

How much should one deposit today in a bank account paying interest compounded quarterly if you wish to have Rs. 10000 at the end of 3 months, if the bank pays 5% annually?

Compulsory audit of account is required u/s 44AB of IT, if the total sales/ turnover exceed _______

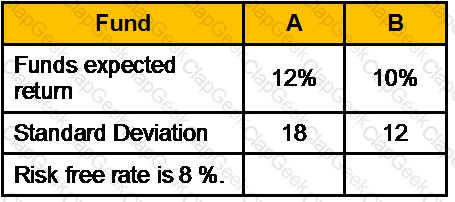

The following parameters are available for two mutual funds:

Calculate Sharpe measure?

An investor investing Rs. 7,282.58 on March 1, 2012 and getting Rs. 10,000 back on February 28, 2017 would have a yield to maturity (YTM) of _____%.

Mr. Rajesh was the owner of an uninsured property. But unfortunetaly the property caught fire because of which he suffered severe financial losses. The reason Mr. Rajesh suffered losses as he did not cover:

In …………………without delivery possession of the mortgaged property, there mortgager binds himself personally to pay the mortgage money

Which of the following costs best describes the cost of foregone income that results from making an economic decision to use funds to purchase a piece of equipment?

As per Hindu succession Act 1956 following person is not considered as a class I heir of the person who dies intestate

The assessed is charged to income-tax in the assessment year following the previous year:

Criminals use ______ to camouflage money flow from criminal activities and pass it off as regular legal money flows.

X Ltd. has failed to remit the tax deducted at source from annual rent of Rs. 6,60,000 paid to Mr. A for its office building. Said rent is —

Is it possible to reduce the risk by adding a security with a higher risk to a security with a lower risk that is already held?

Tax exemption limit for the lump sum received towards Leave encashment on retirement is at _______________

Which of the following measure is most widely used as an indicator of inflation?

If everyone is forced to pay an extra Rs 1000 in taxes each year, "the" multiplier

X Ltd. has failed to remit the tax deducted at source from annual rent of Rs. 6,60,000 paid to Mr. A for its office building. The said rent is