Rusty RoboTech, a robotics technology company, has provided the following financial information for the year 20X3:

• Sales Revenue: $500,000

• Net Income: $50,000

• Dividend Payout: 40% of Net Income

• Total Assets at the beginning of 20X3: $300,000

• Total Liabilities at the beginning of 20X3: $150,000

• Equity at the beginning of 20X3: $150,000

• Historical Cash-to-Sales Ratio: 5%

• Accounts Receivable-to-Sales Ratio: 15%

• Inventory-to-Sales Ratio: 25%

• Cost of Goods Sold-to-Sales Ratio: 43%

For the year 20X4, Rusty RoboTech projects a 20% increase in sales revenue. Other ratios and the dividend policy are expected to remain the same.

What is the projected inventory value for Rusty RoboTech at the beginning of 20X4?

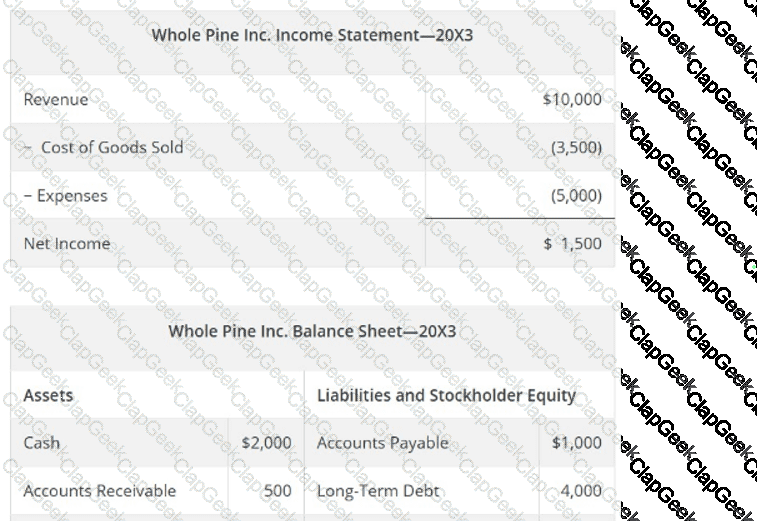

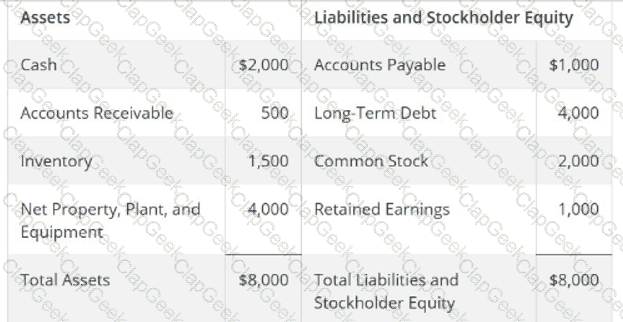

Use Whole Pine Inc.’s financial statements for 20X3 below to answer the following question.

What is Whole Pine Inc.’squick ratiofor 20X3?

A company has a return on assets (ROA) of 10% and total assets of $500 million.

What is its net income?

What is the relationship between the length of the cash cycle and the amount of cash a firm needs to operate?

According to the capital asset pricing model (CAPM), how is a stock with a beta of 1.0 expected to perform relative to the market?

Which practice can help an analyst identify the most relevant financial data and ratios when assessing the financial health of a firm?

Which group does the Securities and Exchange Commission (SEC) work with closely to oversee broker-dealers?

A recent news article reported that a popular tech start-up has not yet reached profitability or experienced a period of positive cash flows from operations. Instead, the company has been focused primarily on capturing market share and attracting new customers.

What does the continued negative cash flow from operations (CFO) signal about this firm?

To answer this question, refer to the cash flow worksheet and the internal rate of return (IRR) calculations. The hospital is only interested in accepting projects with an IRR that exceeds 11%. Assuming the hospital has sufficient capital for both projects and is willing to invest for up to 10 years, which project(s) would the hospital accept?