The Director of Finance, William Seaton, has stopped you in the corridor:

“Your report was really helpful, but the Board is still considering the implications of that email from Jan Archibald at Fouce Oil. I need to make a more detailed report to the Board and I would like you to draft it for me.

I know that we have owned and operated oil wells in the past, but that has always been with the intention of finding a buyer who is prepared to pay a realistic price. We have chosen never to think about the implications of keeping wells.

I need a report from you that covers the following issues:

The key political risks of retaining our interest in these oil wells, with particular emphasis on high consequence, high

likelihood risks.

A suitable response to each of your political risks.

An overview of how changes in the global economy and the demand for oil could affect the decision to proceed.

The challenges associated with putting together a management team to take charge of the production side of this

proposed new strategy.

I realise that this is a lot to ask of you, but I need you to move quickly because of the interest from our biggest shareholder.”

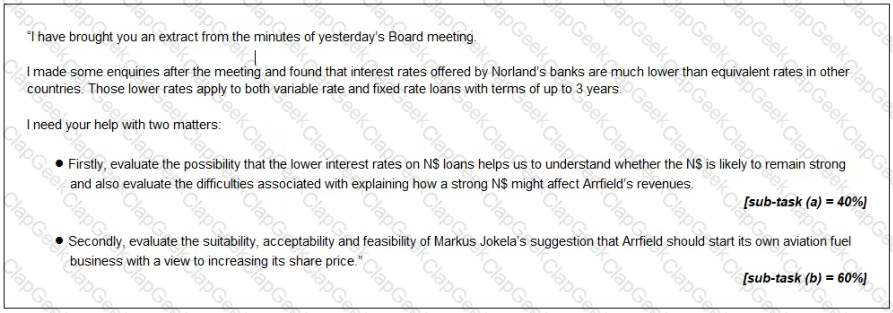

A week later, Romuald Marek stops by your workspace and hands you a document.

The Board minute extract from Romuald can be viewed by clicking the Reference Material button above.

Reference Material

Board minutes extract: proposal to profit from ongoing strength of NS

Anna Obalowu Sole, Chief Operating Officer, reported that the strong NS was helping generate revenues from fuel sales. Discussion followed as to whether the strong N$ was likely to persist and whether a strong N$ benefits Arrfield overall.

Markus Jokela. Chief Executive Officer, stated that the Board should develop contingency plans that could be implemented if it seemed likely that the strong N$ would persist. In particular. Arrfield need not renew the contracts that permit aviation fuel suppliers to operate from its airports. Arrfield would then be free to create its own fuel sale business, buying fuel in bulk to replenish the storage tanks at each of its airports in Norland and then selling it directly to airlines He stated that this would almost certainly enhance Arrfield's share price

Romuald Marek reminded the Board that four of Arrfield's six airports are located in Norland and that those airports charge for aeronautical and non-aeronautical services in N$.

Hello

I have attached a news article

Arrfield does not set the price for aviation fuel sold at our airports, but we do receive a percentage of the revenues earned by the fuel companies.

I need your help to prepare for a Board meeting to discuss this matter Please write a paper covering the following

* Firstly, explain the impact that the criticisms voiced by the environmental campaigners will have on the frequent PESTEL analysis that Arrfield's Board conducts.

[sub-task (a) = 34%

* Secondly, evaluate the commercial logic of Arrfield's strategy of basing charges for non-aeronautical services (such as fuel sales and retail activities) on percentages of the revenues generated by the companies that operate at its airports

[sub-task (b) = 33%)

* Thirdly, recommend with reasons whether Arrfield should attempt to justify strategic decisions to its shareholders when the commercial logic of those decisions is not immediately obvious

[sub-task (c) = 33%}

Thanks

Romuald Marek

Chief Finance Officer