A business has expanded rapidly during the current year. As a result the accounting records have been building up and the management accountant is having problems producing reports for each department head.

Which of the following would be the best solution if introduced?

The petty cash imprest is restored to £500 at the end of each week. The following amounts are paid out of petty cash during week 23:

(a) Stationery - £70.50 (including VAT at 17.5%)

(b) Travelling costs - £127.50

(c) Office refreshments - £64.50

(d) Sundry payables - £120.00 plus VAT at 17.5%

The amount required to restore the imprest to £500.00 is:

Give your answer to 2 decimal places.

Store Y believe customer XF will not be able to pay his £300 debt. Which ONE of the following day books should this 'bad debt' be recorded in?

Refer to the Exhibit.

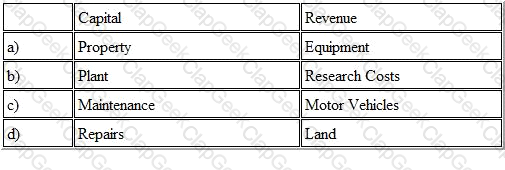

Transactions are often categorized between capital and revenue

Which of the following combinations are correct?

Refer to the Exhibit.

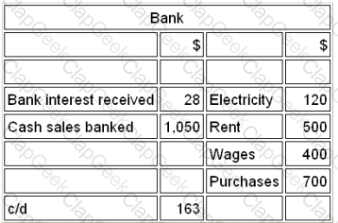

Which of the following would be the opening balance on the bank ledger account?

Accounting standards are needed so that financial statements will fairly and consistently describe financial performance.

What are accounting standards an example of?

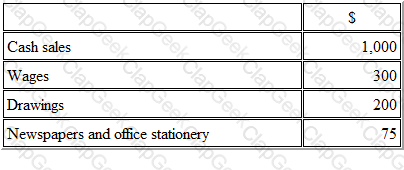

Refer to the Exhibit.

A sole trader, who only has cash sales, banks all cash receipts above the agreed petty cash float of $400.

During week 2 he has the following transactions:

What is the amount banked at the end of week 2?

Accounting standards and company law both influence how assets and liabilities ate classified and presented in financial statements

An amount owing at the year end, due for repayment more from one year from the date that the statement of financial position is being prepared, will be

classified under which of the following headings?

The double entry system underpins all accounting records

Which of the following combinations represent debit balances?

A company is preparing its accounts to 30 November. The latest gas bill received by the company was dated 30 September and included usage charges for the quarter 1 June to 31 August of $5,700 and a service charge of $1,200 for the quarter 1 October to 31 December. It is estimated that the gas bill for the following quarter will be a similar amount.

What will be the amount of the accrual shown in the accounts at 30 November 2006?

Which of the following transactions would be classified as a capital transaction?

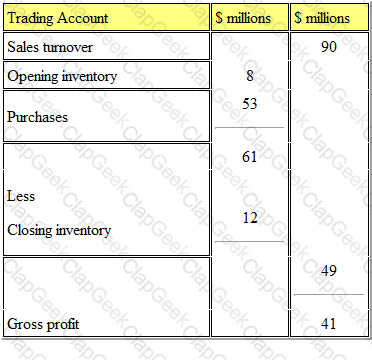

Refer to the exhibit.

A business has the following trading account for its most recent year:

What is its rate of inventory turnover for the year?

Refer to the Exhibit.

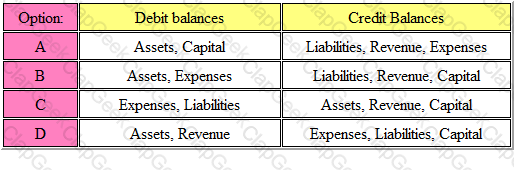

Which of the following balances normally result from the double-entry system of book-keeping?

The answer is:

Which one of the following would not be considered a purpose of segregation of duty?

In relation to accounting coding systems in the computerized records of an entity, which of the following is true?

An entity decides to revalue its freehold property during the current period creating a revaluation surplus.

Where in the current period financial statements would the revaluation surplus appear?

In a cash flow statement, which one of the following would not be found under the section "cash flows from financing activities"?

Under the normal convention of accounting, assets are shown in the balance sheet at:

An invoice for stationery has been debited and credited to the correct accounts but has been duplicated.

This would result in:

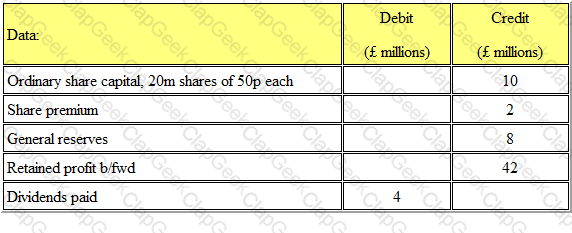

Refer to the exhibit.

The following is an extract from the trial balance of a business for its most recent year:

Net profit before tax has already been calculated as being £27m. Income tax of £5m is to be provided, and a final dividend of 30p per share is declared.

Using some or all of the figures above, the correct figure of retained profit for the year is

Non-current assets can be divided between intangible and tangible assets.

Which THREE of the following are intangible assets?

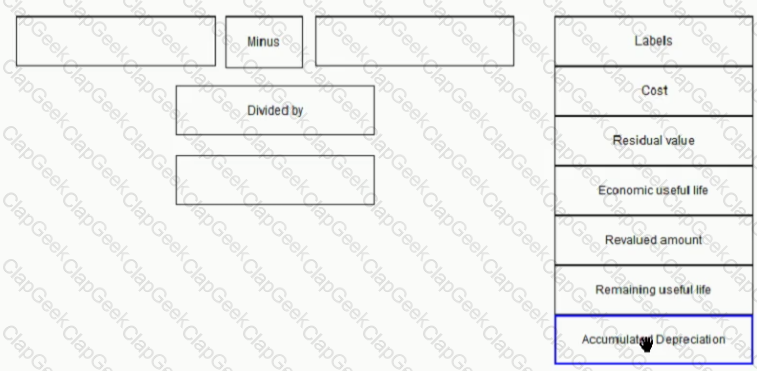

Complete the formula for depreciation of a revalued asset.

Place the relevant labels in the correct positions below.

On 1 January 2001, a company owed a supplier £840.

During the month of January the company purchased goods for £1400 and returned goods valued at £200. A payment of £200 was made towards the outstanding balance. The supplier offered a discount of 5% on purchases.

The balance on the supplier's account at the end of the period is:

On 1 March, a company made a payment of $6,000, in respect of rent for the quarter 1 March - 31 May. The company's year end was 31 March.

What will be the amount of the prepayment shown in the accounts at the year end?

Which of the following would not require an adjustment to be made to the cashbook?

Different users have different needs from financial information. One of which is to know about the company's ability pay its debts

Which of the following users will have this need for information?

If the royalty cost falls on items used in the manufacturing process, which TWO of the following would be true?

AB commenced trading on 1 January 20XS. introducing $50,000 cash and $15,000 of assets to the business. The profit earned and retained in the business for the year ended 31 December 20X6 was $160,000. AB's closing capital at 31 December 20X5 was $190,000.

What is the value of AB's drawings for the year ending 31 December 20X5?

Which ONE of the following deals with problems that arise with existing accounting standards?

Company A has a receivables turnover ratio of six times, while Company B, which operates in the same market sector, has a receivables turnover ratio of five times.

This suggests that

Company H receives a 10% discount on its order from supplier GD. Which ONE of the following does the discounted amount count as for Company H?

Your organization paid $120250 in net wages to its employees during the year.

Employees' tax and national insurance amounted to $32000 and employers national insurance was $11000. Employees had contributed $6250 to a superannuation scheme.

The amount to be charged against profits for the year, in respect of wages is

STU has an accounting period end of 31 December 20X8 During the year STU paid $4,800 for business insurance to cover the year to 30 June 20X9 The amount paid for business insurance for 30 June 20X8 was $4,500.

What is the insurance expense to be recognized in the statement of profit or loss of STU for the year ended 31 December 20X8? Give your answer to the nearest $

Which ONE of the following does not apply to the preparation of management accounts?

Who is responsible for ensuring that internal control systems operate efficiently?

The suspense account of a company was opened with a credit balance of $360 when the trial balance failed to agree.

This could have arisen because

An organization’s cash book has an opening balance in the bank column of $4,850 credit.

The following transactions then took place:

(a) Cash sales of $14,500, including VAT of $1,500.

(b) Receipts from customers of debts of $24,000.

(c) Payments to creditors of debts of $18,000, less 5% cash discount.

(d) Dishonored cheques from customers amounting to $2,500.

The resulting balance in the bank column of the cash book should be:

A non-current asset was purchased for £240000 at the beginning of Year 1, with an expected life of 7 years and a residual value of £50000. It was depreciated by 20% per annum using the reducing balance method.

At the beginning of Year 4 it was sold for £100000. The result of this was:

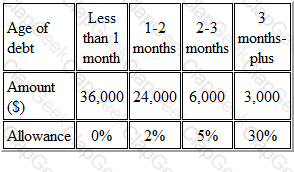

Refer to the Exhibit.

Berber Limited is preparing its year-end accounts and is reviewing the method used to estimate the allowance for receivables.

An aged receivables schedule shows the following position:

The company believes that the previous percentages used were not prudent enough and it has decided to increase the percentages on 2-3 months debt to 10% and on 3 months plus debt to 50%. The current allowance for receivables is $1,500.

What would be the effect on the income statement of the change in accounting policy

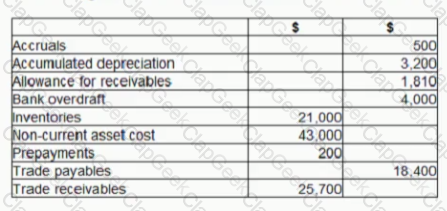

The following is an extract of the trial balance of XYZ as at 31 December 20X7

What is the total value of assets to be included in the statement of financial position? Give your answer to the nearest $

After calculating your company's profit for the year, you discover that:

(a) A non-current asset costing £2,000 has been included in the purchases account; the asset has not been included in the closing inventory figure; nor has it been depreciated by the normal 25% per annum

(b) Closing inventory of raw materials, costing £500, have been treated as closing inventory of stationery.

These two errors have had the effect of.

The reducing balance method of depreciating fixed assets is more appropriate than the straight line method when:

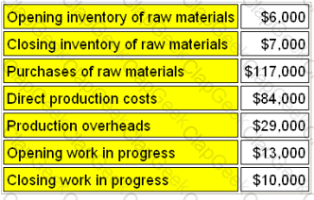

Refer to the Exhibit.

The following information is available for the period for AC Limited, a manufacturing company:

The factory cost of goods completed for the period was

A business will maintain a non-current asset register to keep a record of all non-current assets held.

Which THREE of the following are examples of information contained within the register?

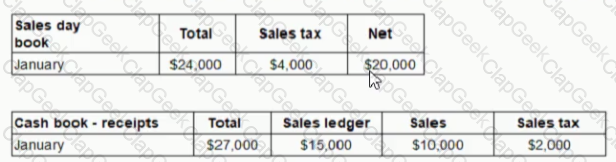

LMN's totals for its sales day book and its cash receipts book for the month ended 31 January 20X6 are as follows

What is the total value for sales that LMN will post to the sales account in the nominal ledger for January 20X6?

Your organization owed VAT of $22,700 at the beginning of the month.

During the month, it sold standard-rated goods with a net value of $600,000. Its purchases and expenses during the same month amounted to $188,000 including VAT. It paid VAT to the Revenue and Customs, of $33,400. The VAT rate is 17.5%

At the end of the month, the balance on the VAT account was:

Which of the following transactions would be classified as a revenue transaction?