U+ Bank presents various credit card offers to its customers on its website. The bank uses AI to prioritize the offers according to customer behavior. With the introduction of the Gold credit card offer, the offer click-through propensity decreased to 0.42.

What does the decrease in the propensity value most likely indicate?

U+ Bank's marketing department wants to use the always-on outbound approach to send promotional emails about credit card offers to qualified customers. As a part of this promotion, the bank wants to identify the starting population by defining a few high-level criteria in a segment.

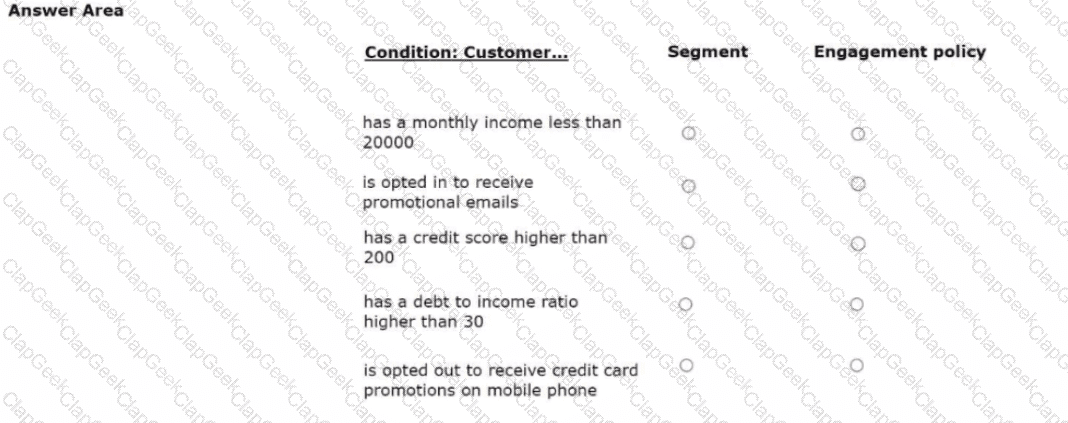

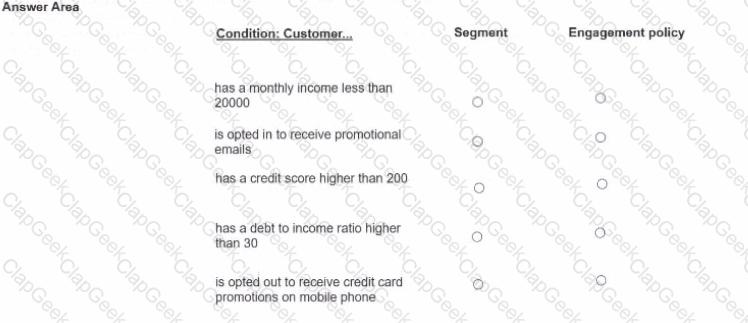

For each condition below, select which two conditions should be defined in Segment and which three conditions should be defined in Engagement policy as best practice.

U+ Bank wants to use Pega Customer Decision Hub™ to show the Reward Card offer on its website to the qualified customers. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning architect, you need to verify the configurations in the Channel tab of the Next-Best-Action Designer to enable the website to communicate with Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you ensure are complete in the Channel tab of the Next-Best-Action Designer? (Choose Two)

A customer qualifies for Standard card (priority 60), Rewards card {priority 40), and Premium card {priority 30). Standard card volume is exhausted. Rewards card has remaining volume, and Premium card has remaining volume. The system uses "Return any action that does not exceed constraint" mode.

Which actions does the customer receive in this scenario?

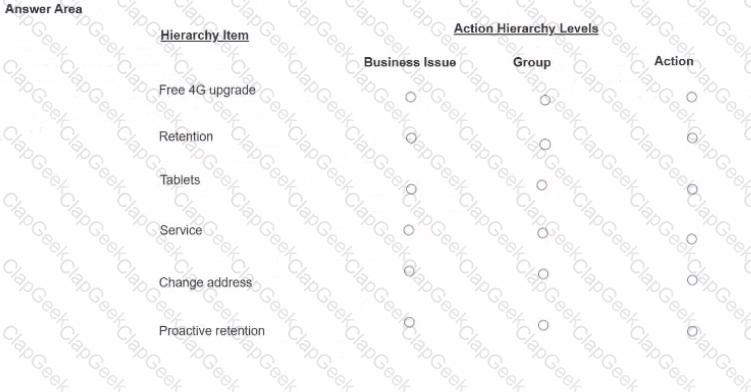

As a decisioning architect, you are setting up the action hierarchy for MyCo. Select the correct action hierarchy level for each of the hierarchy items identified.

What is the name of the property that the system computes automatically when you use an Adaptive Model decision component?

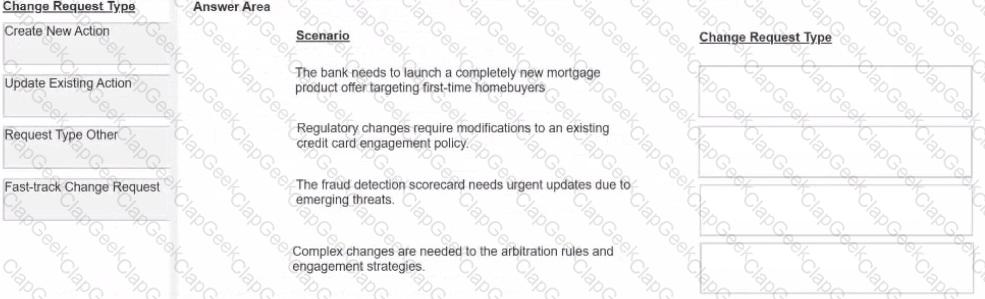

U+ BankT a retail bank, uses Pega Customer Decision Hub™ to manage various business changes throughout their operations The bank's team members need to understand which change request type to use tor different business scenarios they encounter

Select each change request type on the left, and drag it to the matching scenario descriptions on the right:

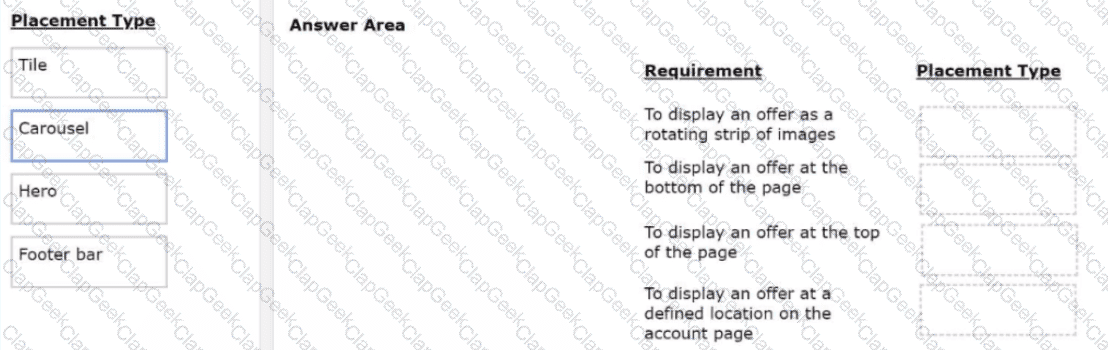

U+ Bank has decided to use the Pega Customer Decision Hub, M to recommend more relevant banner ads to its customers when they visit the personal portal. Select each placement type on the left and drag it to the correct requirement on the right.

A bank has been running traditional marketing campaigns for many years. One such campaign sends an offer email to qualified customers on day one. On day five, the bank presents a similar offer if the first email is ignored.

If you re-implement this requirement by using the always-on outbound customer engagement paradigm, how do you approach this scenario?

U+- Bank, a retail bank, has recently Implemented a project in which qualified customers see mortgage offers when they log in to the web self-service portal.

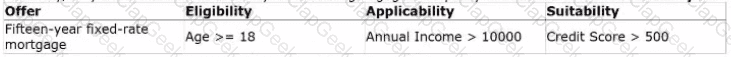

Currently, only the customers who satisfy the following engagement policy conditions receive the Fifteen-year fixed-rate mortgage offer:

The bank decides to make two changes:

1. Update the suitability condition for the Fifteen-year fixed-rate mortgage offer.

2. Introduce a new offer, Twenty-year fixed-rate mortgage.

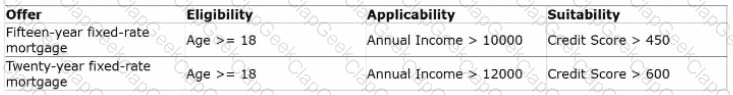

The following table shows the new engagement policy conditions for both mortgage offers:

What is the best practice to fulfill this change management requirement in the business operations environment?

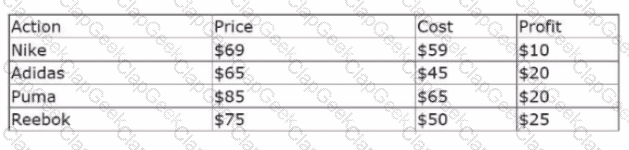

The following decision strategy outputs the most profitable shoe a retailer can sell. The profit is the selling Prices of the shoe, minus the Cost to acquire the shoe.

The details of the shoes are provided in the following table:

The details of the shoes are provided in the following table:

To output the most profitable shoe, which component do you add in the blank space that is highlighted in red?

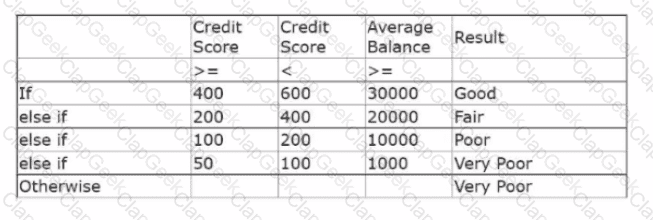

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning architect, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

An NBA Specialist Is configuring the engagement policy for a new loan offer and wants to validate the policy. What is the best way for the NBA Specialist to validate the engagement policy?

U+ Bank wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?

U+ Bank wants to use Pega Customer Decision Hub™ to display a credit card offer, the Standard Card, to every customer who logs in to the bank website. What three of the following artifacts are mandatory to implement this requirement7 (Choose Three)

As a decisioning architect, how can you optimize the strategies that are based on Insights that you gain from the AI Insight feature in the Customer Profile Viewer?

As a Customer Service Representative, you present an offer to a customer who called to learn more about a new product. The customer rejects the offer. What is the next step that Pega Customer Decision Hub takes?

U+ Bank's marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want to show offers on a customer's account page if the customer has already received three home loan offers in the last two weeks.

What do you need to define to implement the business requirement?

U+ Bank is promoting a new premium credit card with an 18% APR to its existing customers. To protect customer value, the bank wants to avoid offering this card to customers who already hold a credit card with a lower Interest rate (12% APR or below).

Which engagement policy condition type should you use to exclude customers with lower-interest cards from receiving the premium offer?

U+Bank presents various credit card offers to Its customers on Its website. The bank uses AI to prioritize the offers according to customer behavior. After the introduction of the Gold credit card offer, the offer click-through propensity decreased to 0.42.

What does the decrease in the propensity value most likely indicate?

A financial services company has implemented always-on outbound campaigns for three credit card offers: Standard card. Rewards card, and Rewards Plus card. The marketing team observes that customers who are qualified for multiple actions receive different numbers of offers, depending on the configuration of the volume constraint mode. To optimize customer engagement, the system administrator must choose between constraint modes.

Which volume constraint mode ensures that customers receive all actions for which they qualify, provided the actions do not reach volume limits?

U+ Bank's marketing department wants to use the always-on outbound approach to send promotional emails about credit card offers to qualified customers. As a part of this promotion, the bank wantsto identify the starting population by defining a few high-level criteria ina segment.

For each condition below, select which two conditions should be defined in Segment and which three conditions should be defined in Engagement policy as best practice

Regional Bank has a fully implemented 1:1 customer engagement solution that is in the business-as-usual phase. A business user from this bank identifies the need for a new promotional offer for customers who regularly use mobile banking services. The user has detailed requirements including eligibility criteria, treatment messaging, and implementation timeline.

Which process should the business user follow to implement the new action?

U+ Bank is facing an unforeseen technical issue with its customer care system. As a result, the bank wants to share the new temporary contact details with all customers over an SMS.

Which type of outbound interaction do you configure to implement this requirement?

Myco Bank, a retail bank, uses the Customer Engagement Blueprint to design personalized customer journeys. The bank wants to better understand its diverse customer base to create more targeted engagement strategies.

What key achievement does the Personas stage provide for Myco Bank when implementing with Customer Engagement Blueprint?

U+ Bank, a retail bank, is facing an unforeseen technical issue with its customer care system. As a result, the bank wants to share the new temporary contact details with all customers over an SMS. All customers must receive this communication regardless of the engagement policy conditions and constraints.

Which type of communication do you configure to implement this requirement?

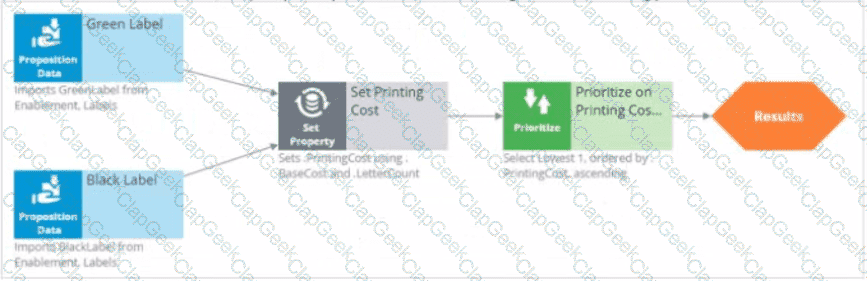

As shown in the following figure, decision strategy contains 'Green Label' and 'Black Label' Proposition components that point to the "Set Printing Cost' Set Property component that uses 'BaseCost' and "LetterCount." The configuration of the Prioritize component selects the lowest cost. What is the role of the Set Property component in the following decision strategy?

U+ Bank, a retail bank, is designing an engagement policy for its credit card promotions. To meet legal requirements, the bank must ensure that only customers aged 18 or older are considered for any credit card offer.

Which policy configuration level should U+ Bank use to implement the age requirement (18+ years) for all credit card promotions?