A company has invested $500,000 in developing a new product and requires a return of 12% on this investment.

The company has researched the market and has set the selling price for the new product at $300 per unit. At this price, sales volume for next year is forecast to be 500 units. The forecast unit cost is $210.

What is the target cost gap per unit for the coming year?

Give your answer to the nearest whole $.

A group consists of two divisions, Alpha and Beta, both of which are profit centers. Alpha sells a product to the external market and also sells it as an intermediate product to Beta.

Beta then processes further before selling the final product to the external market. The current group transfer pricing policy requires Alpha to charge Beta with the variable cost of production.

Which of the following statements is valid?

Which of the following statements about modified internal rate of return (MIRR) and internal rate of return (IRR) is correct?

A manager must decide which one of three projects should be implemented. For each project the possible outcomes and their associated probabilities can be estimated reliably. The manager has decided to make the decision based solely on which project has the highest expected value of profit.

Which of the following statements are correct?

Select ALL that apply.

A company is investing $150,000 in a project which will yield an annual cash inflow of $40,000 for eight years. The company's cost of capital is 10%.

To the nearest $100, what is the project's equivalent annual net present value?

A supermarket group has experienced operational problems during recent years, including a shortage of warehousing space due to increasing turnover and poor inventory management. The product portfolio has expanded considerably. Although this has led to increased sales volume, marketing and logistics costs have increased disproportionately. Non product-specific costs have also increased significantly.

Management is now considering using Direct Product Profitability (DPP).

Which of the following statements are valid in respect of the possible implementation of DPP within the supermarket group?

Select ALL that apply.

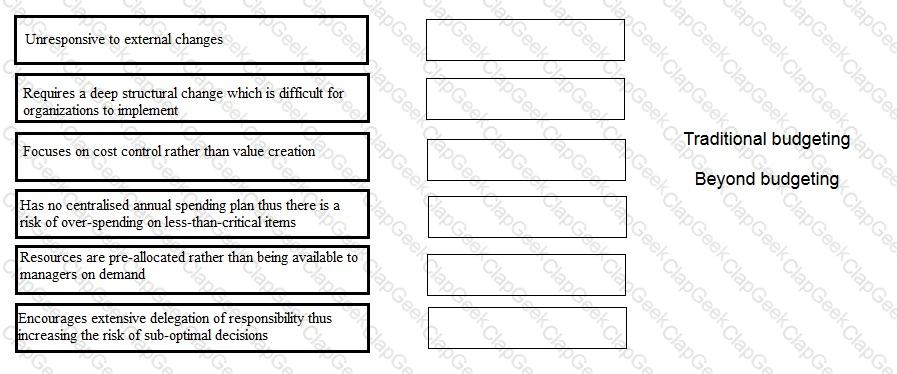

Which of the following criticisms relate to traditional budgeting methods and which relate to the 'beyond budgeting' approach?

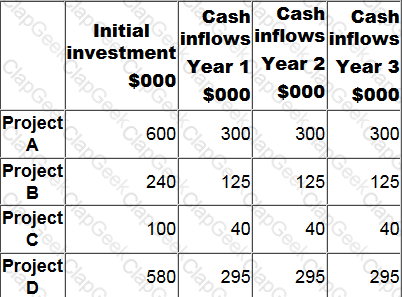

The following information is available for four investment projects:

A discount rate of 12% is appropriate for all four projects. The organization is subject to capital rationing and wishes to prioritise the projects using the profitability index (PI).

Which project has the highest PI?

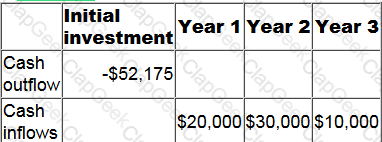

The cash flows from a project are detailed in the table below.

To the nearest 1%, what is the project's internal rate of return?

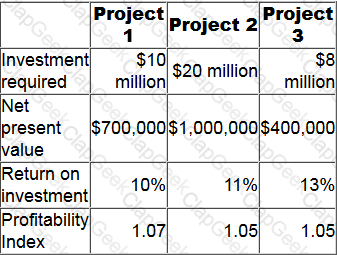

A company has a cost of capital of 12% and a maximum of $20 million to invest. It has identified three possible investment projects, none of which is divisible, as follows.

Which project(s) should the company invest in?

One of an investment centre's products is sold on an external market. Output is limited because the specialist machine that manufactures the product is operating at full capacity.

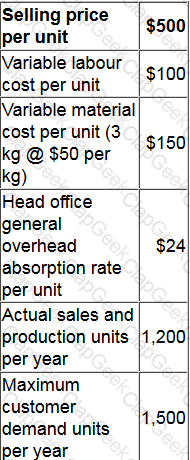

Current data for the product are as follows.

Investigations have identified that more rigorous maintenance of the machine at an annual cost of $5,000 would reduce the number of breakdowns and increase its capacity to 1,300 units per year.

There would be no change in the selling price if more units were sold. Any additional labor hours would be paid a premium of 25%. A discount of 2% of the cost of all materials purchased is available if the company increases its purchases to 3,700 kg or more per year.

What would be the increase in the investment centre's annual controllable profit if more rigorous maintenance is undertaken?

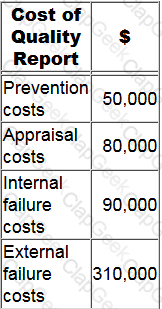

The following cost of quality report has been prepared for the latest period.

What is the difference between the cost of conformance and the cost of non-conformance?

An organization is competing in the high technology market. It sets a high sales price for its products initially to target the early adopters, and then the price is gradually reduced.

This pricing strategy is known as:

There is a 60% probability of a project yielding a positive net present value (NPV) of $280,000 and a 30% probability of it yielding a positive NPV of $140,000.

The only other possible outcome is that the project will yield a negative NPV of $160,000.

What is the expected value of the project's NPV?

Risk management can be represented as a four step process. The four steps, shown randomly, are:

1. Establish appropriate risk management policies.

2. Risks are identified by key stakeholders.

3. Risks are monitored on an ongoing basis.

4. Risks are evaluated according to the likelihood of occurrence and impact on the organization.

Which of the following is the correct order for the four steps?

An organization has carried out a risk assessment for a project.

Which of the following possible outcomes are examples of upside risk?

Select ALL that apply.

It is often claimed that a two-part transfer pricing system offers a number of advantages to organizations which use it.

Which of the following statements is NOT an advantage of using a two-part transfer pricing system?

A project with a 6 year life generates a positive net present value of $1,100. The discount rate is 8%.

To the nearest $, the equivalent annual benefit is:

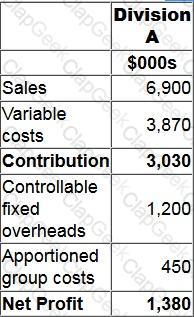

Division A is an investment centre with assets of $7.3 million. The following is an extract from the annual budget for division A:

The cost of capital is 14%.

Calculate the residual income for division A.

Which TWO of the following are reasons why cost-based approaches to transfer pricing are often used in practice?

In order to remain competitive an organization wishes to achieve cost savings for one of its existing products.

Which of the following correctly describes methods which the organization can use to achieve these cost savings?

Select ALL that apply.

A company expects to sell 3,600 units of Product A at a selling price of $750 per unit during the forthcoming year. The currently expected variable cost per unit is $860 per unit. The company requires a return of 15% during the forthcoming year on its investment of $2.4 million in Product A. Absorbed general overheads are expected to amount to $40 per unit.

What is the target cost for each unit of product A in the forthcoming year?

Kaizen costing is being used by an organization to gradually reduce the unit cost of one of its products in order to achieve a 20% mark up on the product's cost.

The selling price of the product must be $72 per unit and this selling price has been maintained for two years.

Two years ago the product's cost was $3 per unit more than its selling price. Kaizen costing has achieved an 8% reduction from the previous period's unit cost in each of the past two years. The organization expects to continue to achieve the same rate of cost reduction next year.

Which of the following statements provides an accurate analysis of the extent to which Kaizen costing has been successful in achieving the required unit cost for the product?

A company comprises several divisions.

One of these divisions was originally expected to earn an operating profit next year of $800,000 on net assets of $4 million.

However, the divisional manager is considering investing in a project that would generate a project return on investment (ROI) of 38% on additional net assets of $500,000.

What would be the divisional ROI next year if the project was implemented?

Give your answer to the nearest percentage.

A firm of accountants uses an activity-based costing system. The firm's costing system permits staff to indicate specific tasks undertaken for clients, such as requesting missing information. The amount charged for a request for missing information is based on the following analysis.

Each request takes an average of 15 minutes of professional staff time. Professional staff are charged out at $100 per hour.

Administrators then process the information request and prepare a standard letter. The average time administration staff spend on each information request is 20 minutes. The cost of administration staff at the firm is $75,600 per year. Administration staff work for a total of 6,000 hours per year. The cost of printing and posting a letter is $1.

Calculate the cost of an information request.

Give your answer to 2 decimal places.

Company TTM has the opportunity to invest $60,000 in a project. The project is anticipated to produce annual returns of $12,500 each year for 8 years. The cost of capital is 12%.

What is the net present value of the project? Give your answer to the nearest whole number.

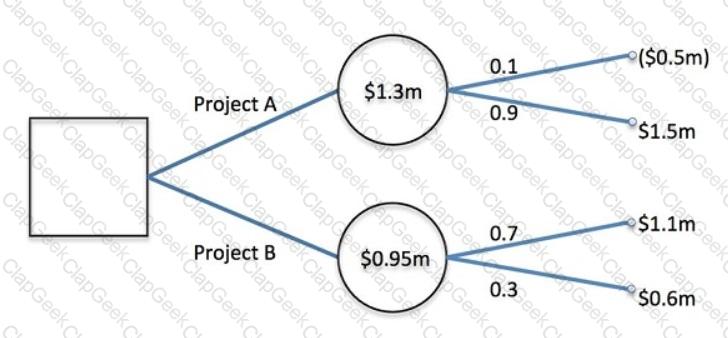

A company is deciding whether to invest in project A or project B. A decision tree has been prepared to illustrate the investment decision and its associated possible net present values (NPVs).

Which of the following statements is correct?