An auto accident in Chicago, Illinois has been reported to Succeed Insurance. The customer service representative uses the ClaimCenter standard Claim Wizard to set up the new claim. The policy is verified in effect and based on the reported exposures the total loss points calculated is 38. There is also a note to have an expert inspection via approved vendor.

What is the most likely claim setup with regards to this reported auto accident?

A sales executive and business traveler has a full coverage auto policy through his insurance company. The executive lives in Detroit, Michigan and often drives across the border to visit client offices in Canada.

While driving in downtown Toronto, the executive's car was hit by a truck coming the wrong way. He called his insurance company to report a claim for this accident. However, the Customer Service Representative (CSR) cannot confirm there is an active policy on file.

How should this claim be handled?

A Business Analyst (BA) has identified a new typecode essential for Succeed Insurance implementation. During adjudication, Adjusters need to be able to update the loss cause value to reflect the new typecode.

Which tabs in a Guidewire Story Card should be used to document the business requirement?

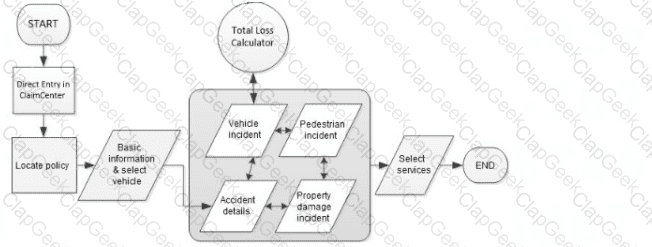

Whenever the Total Loss Calculator determines that a vehicle is a total loss, Succeed Insurance wants to create a custom history event with the exposure name and total loss score.

Which step in the claim setup process flow must be completed before the history event can be created?

A car accident in a rural area of Durango, Colorado is reported to Succeed Insurance. The driver of the damaged car reportedly hit the base of a windmill tower while driving at night. There was no other passenger in the car when the accident happened, and the driver has a valid auto policy on file.

While the driver is not physically injured, the entire passenger side of the car has been severely damaged. Although the windmill is still functioning, the base of the tower has sustained multiple broken parts.

Which two incidents need to be created for the claim based on the reported accident? (Choose two.)

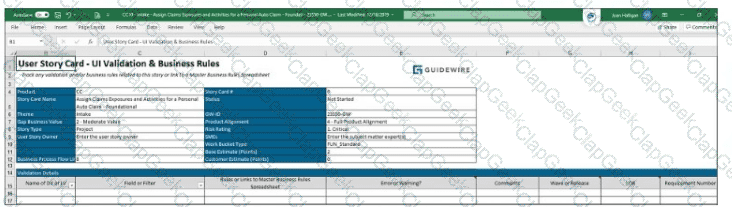

At Succeed Insurance, new personal auto claims involving a fatality are assigned to a High Complexity Auto group made up of Adjusters with at least eight years of experience dealing with the issues and emotions commonly found in claims involving fatalities. Fatality claims typically take 18 to 24 days to complete. The assigned Business Analyst (BA) will document the assignment rule for this requirement in User Story Card Assign Claims Exposures and Activities for a Personal Auto Claim - Foundational. The existing tab UI Validation & Business Rules shown below is not a good fit for assignment rules, so a new tab will be added to the Story Card.

Which two sets of columns should the new tab include to accurately capture the assignment rule requirements? (Choose two.)

Succeed Insurance allows field Adjusters to write checks directly to the insured to cover damage costs for minor claims such as:

Personal auto claims involving cracked windshields

Homeowners claims involving minor glass breakage

The Adjuster uses the Manual Check Wizard to record the check number and amount against a reserve line. Succeed requires Supervisor approval for all manual checks to ensure that the paper checks are verified against the payment information in ClaimCenter.

Which two limits or rules must be configured in ClaimCenter to ensure that these manual payments are sent to the correct person for approval? (Choose two.)

What are two recommended best practices with user interface (UI) mock-ups in a ClaimCenter implementation project? (Choose two.)

To optimize business process workflow, an insurer has spent a great deal of effort on estimating the amount of effort required to complete various types of work... They are also aware that certain situations may require specialized expertise and want to incorporate this in their decision making.

All claims and exposures are entered using only the ClaimCenter new claim wizard. Once entered, the work should be automatically distributed fairly to those properly suited, as determined by the company's knowledge of each worker's skill set.

Which two assignment mechanisms, alone or together, will achieve their goal? (Choose two.)

A commercial auto claims group at Succeed Insurance has a large number of overdue activities related to service requests. Reviewing the distribution of these activities across the team, the supervisor sees that one Adjuster on the team owns only one of these activities, while the other Adjusters own five or six.

To expedite completion of these activities, the Supervisor decides that the Adjuster with one service request activity will handle all of the overdue service activities for the team.

Which screen can the Supervisor use to most efficiently reassign these service request activities?

Drivers for Rideshare companies need insurance that provides protection when they are driving the vehicle for personal reasons. This will be the Succeed Insurance standard Personal Auto Policy. However, they also need insurance to protect them from the increased risks associated with working as a Rideshare Driver. This would include when they are logged in to the Rideshare application waiting for a customer match, on their way to pick up a customer, but not when a customer has entered the vehicle.

When a driver is working as a Rideshare Driver, this new Rideshare coverage will protect them from the following types of risks, and there is a need to be able to collect the appropriate information about the losses:

. Injury to a first-party driver

. Damaged personal property of the third-party passengers

Which two exposures need to be configured? (Choose two.)