A local council is looking at ways it can fund a large construction project they are planning—the building of a new hospital. Discuss ways in which the council could fund the project, and the advantages and disadvantages of this (25 points)

See the answer in Explanation below:

A local council, operating in the public sector, has several options to fund a large construction project like a new hospital. Below are three funding methods, with their advantages and disadvantages explained step-by-step:

Government Grants or Funding

Step 1: Identify SourceApply for grants from central government or public health budgets allocated for infrastructure.

Step 2: ProcessSubmit detailed proposals outlining costs, benefits, and public value to secureapproval.

Advantages:

No repayment required, preserving council funds.

Aligns with public sector goals of service delivery.

Disadvantages:

Competitive process with uncertain approval.

Strict conditions may limit flexibility in project execution.

Public-Private Partnership (PPP)

Step 1: Establish PartnershipCollaborate with a private firm to finance and build the hospital, with the council leasing it back over time.

Step 2: ProcessNegotiate terms (e.g., Private Finance Initiative—PFI) where the private partner recovers costs via payments or service contracts.

Advantages:

Reduces upfront council expenditure, spreading costs over years.

Leverages private sector expertise and efficiency.

Disadvantages:

Long-term financial commitments increase future budgets.

Potential loss of control over project specifications.

Borrowing (e.g., Municipal Bonds or Loans)

Step 1: Secure FundsIssue bonds to investors or obtain loans from financial institutions, repayable over decades.

Step 2: ProcessGain approval from government regulators and allocate tax revenues for repayment.

Advantages:

Immediate access to large capital for construction.

Retains council ownership of the hospital.

Disadvantages:

Interest payments increase overall project cost.

Debt burden may strain future budgets.

Exact Extract Explanation:

The CIPS L5M4 Study Guide highlights funding options for public sector projects:

Government Grants:"Grants provide non-repayable funds but often come with stringent compliance requirements" (CIPS L5M4 Study Guide, Chapter 4, Section 4.4).

PPP:"Public-private partnerships enable infrastructure development without immediate fiscal pressure, though long-term costs can escalate" (CIPS L5M4 Study Guide, Chapter 4, Section 4.5).

Borrowing:"Borrowing via bonds or loans is common for public bodies, offering flexibility but adding debt obligations" (CIPS L5M4 Study Guide, Chapter 4, Section 4.2).These align with the public sector’s focus on value for money and service provision. References: CIPS L5M4 Study Guide, Chapter 4: Sources of Finance.===========

Peter is looking to put together a contract for the construction of a new house. Describe 3 different pricing mechanisms he could use and the advantages and disadvantages of each. (25 marks)

See the answer in Explanation below:

Pricing mechanisms in contracts define how payments are structured between the buyer (Peter) and the contractor for the construction of the new house. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, selecting an appropriate pricing mechanism is crucial for managing costs, allocating risks, and ensuring value for money in construction contracts. Below are three pricing mechanisms Peter could use, along with their advantages and disadvantages, explained in detail:

Fixed Price (Lump Sum) Contract:

Description: A fixed price contract sets a single, predetermined price for the entire project, agreed upon before work begins. The contractor is responsible for delivering the house within this budget, regardless of actual costs incurred.

Advantages:

Cost Certainty for Peter: Peter knows the exact cost upfront, aiding financial planning and budgeting.

Example: If the fixed price is £200k, Peter can plan his finances without worrying about cost overruns.

Motivates Efficiency: The contractor is incentivized to control costs and complete the project efficiently to maximize profit.

Example: The contractor might optimize material use to stay within the £200k budget.

Disadvantages:

Risk of Low Quality: To stay within budget, the contractor might cut corners, compromising the house’s quality.

Example: Using cheaper materials to save costs could lead to structural issues.

Inflexibility for Changes: Any changes to the house design (e.g., adding a room) may lead to costly variations or disputes.

Example: Peter’s request for an extra bathroom might significantly increase the price beyond the original £200k.

Cost-Reimbursable (Cost-Plus) Contract:

Description: The contractor is reimbursed for all allowable costs incurred during construction (e.g., labor, materials), plus an additional fee (either a fixed amount or a percentage of costs) as profit.

Advantages:

Flexibility for Changes: Peter can make design changes without major disputes, as costs are adjusted accordingly.

Example: Adding a new feature like a skylight can be accommodated with cost adjustments.

Encourages Quality: The contractor has less pressure to cut corners since costs are covered, potentially leading to a higher-quality house.

Example: The contractor might use premium materials, knowing expenses will be reimbursed.

Disadvantages:

Cost Uncertainty for Peter: Total costs are unknown until the project ends, posing a financial risk to Peter.

Example: Costs might escalate from an estimated £180k to £250k due to unexpected expenses.

Less Incentive for Efficiency: The contractor may lack motivation to control costs, as they are reimbursed regardless, potentially inflating expenses.

Example: The contractor might overstaff the project, increasing labor costs unnecessarily.

Time and Materials (T&M) Contract:

Description: The contractor is paid based on the time spent (e.g., hourly labor rates) and materials used, often with a cap or “not-to-exceed” clause to limit total costs. This mechanism is common for projects with uncertain scopes.

Advantages:

Flexibility for Scope Changes: Suitable for construction projects where the final design may evolve, allowing Peter to adjust plans mid-project.

Example: If Peter decides to change the layout midway, the contractor can adapt without major renegotiation.

Transparency in Costs: Peter can see detailed breakdowns of labor and material expenses, ensuring clarity in spending.

Example: Peter receives itemized bills showing £5k for materials and £3k for labor each month.

Disadvantages:

Cost Overrun Risk: Without a strict cap, costs can spiral if the project takes longer or requires more materials than expected.

Example: A delay due to weather might increase labor costs beyond the budget.

Requires Close Monitoring: Peter must actively oversee the project to prevent inefficiencies or overbilling by the contractor.

Example: The contractor might overstate hours worked, requiring Peter to verify timesheets.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide dedicates significant attention to pricing mechanisms in contracts, particularly in the context of financial management and risk allocation. It identifies pricing structures like fixed price, cost-reimbursable, and time and materials as key methods to balance cost control, flexibility, and quality in contracts, such as Peter’s construction project. The guide emphasizes that the choice of pricing mechanism impacts "financial risk, cost certainty, and contractor behavior," aligning with L5M4’s focus on achieving value for money.

Detailed Explanation of Each Pricing Mechanism:

Fixed Price (Lump Sum) Contract:

The guide describes fixed price contracts as providing "cost certainty for the buyer" but warns of risks like "quality compromise" if contractors face cost pressures. For Peter, this mechanism ensures he knows the exact cost (£200k), but he must specify detailed requirements upfront to avoid disputes over changes.

Financial Link: L5M4 highlights that fixed pricing supports budget adherence but requires robust risk management (e.g., quality inspections) to prevent cost savings at the expense of quality.

Cost-Reimbursable (Cost-Plus) Contract:

The guide notes that cost-plus contracts offer "flexibility for uncertain scopes" but shift cost risk to the buyer. For Peter, this means he can adjust the house design, but he must monitor costs closely to avoid overruns.

Practical Consideration: The guide advises setting a maximum cost ceiling or defining allowable costs to mitigate the risk of escalation, ensuring financial control.

Time and Materials (T&M) Contract:

L5M4 identifies T&M contracts as suitable for "projects with undefined scopes," offering transparency but requiring "active oversight." For Peter, thismechanism suits a construction project with potential design changes, but he needs to manage the contractor to prevent inefficiencies.

Risk Management: The guide recommends including a not-to-exceed clause to cap costs, aligning with financial management principles of cost control.

Application to Peter’s Scenario:

Fixed Price: Best if Peter has a clear, unchanging design for the house, ensuring cost certainty but requiring strict quality checks.

Cost-Reimbursable: Ideal if Peter anticipates design changes (e.g., adding features), but he must set cost limits to manage financial risk.

Time and Materials: Suitable if the project scope is uncertain, offering flexibility but demanding Peter’s involvement to monitor costs and progress.

Peter should choose based on his priorities: cost certainty (Fixed Price), flexibility (Cost-Reimbursable), or transparency (T&M).

Broader Implications:

The guide stresses aligning the pricing mechanism with project complexity and risk tolerance. For construction, where scope changes are common, a hybrid approach (e.g., fixed price with allowances for variations) might balance cost and flexibility.

Financially, the choice impacts Peter’s budget and risk exposure. Fixed price minimizes financial risk but may compromise quality, while cost-plus and T&M require careful oversight to ensure value for money, a core L5M4 principle.

Discuss ways in which an organization can improve their short-term cash flow (25 points)

See the answer in Explanation below:

Improving short-term cash flow involves strategies to increase cash inflows and reduce outflows within a short timeframe. Below are three effective methods, explained step-by-step:

Accelerating Receivables Collection

Step 1: Tighten Credit TermsShorten payment terms (e.g., from 60 to 30 days) or require deposits upfront.

Step 2: Incentivize Early PaymentsOffer discounts (e.g., 1-2% off) for payments made before the due date.

Step 3: Automate ProcessesUse electronic invoicing and reminders to speed up debtor responses.

Impact on Cash Flow:Increases immediate cash inflows by reducing the time money is tied up in receivables.

Delaying Payables Without Penalties

Step 1: Negotiate TermsExtend payment terms with suppliers (e.g., from 30 to 60 days) without incurring late fees.

Step 2: Prioritize PaymentsPay critical suppliers first while delaying non-urgent ones within agreed terms.

Step 3: Maintain RelationshipsCommunicate transparently with suppliers to preserve goodwill.

Impact on Cash Flow:Retains cash longer, improving short-term liquidity.

Selling Surplus Assets

Step 1: Identify AssetsReview inventory, equipment, or property for underutilized or obsolete items.

Step 2: Liquidate QuicklySell via auctions, online platforms, or trade buyers to convert assets to cash.

Step 3: Reinvest ProceedsUse funds to meet immediate cash needs or reduce short-term borrowing.

Impact on Cash Flow:Provides a quick influx of cash without relying on external financing.

Exact Extract Explanation:

The CIPS L5M4 Study Guide emphasizes practical techniques for short-term cash flow management:

Receivables Collection:"Accelerating cash inflows through tighter credit policies and incentives is a primary method for improving liquidity" (CIPS L5M4 Study Guide, Chapter 3, Section 3.2).

Delaying Payables:"Extending supplier payment terms, where possible, preserves cash for operational needs" (CIPS L5M4 Study Guide, Chapter 3, Section 3.5), though it advises maintaining supplier trust.

Asset Sales:"Liquidating surplus assets can provide an immediate cash boost in times of need" (CIPS L5M4 Study Guide, Chapter 3, Section 3.6), particularly for organizations with excess resources.These approaches are critical for procurement professionals to ensure financial agility. References: CIPS L5M4 Study Guide, Chapter 3: Financial Management Techniques.

What is meant by the term benchmarking? (10 points) Describe two forms of benchmarking (15 points)

See the answer in Explanation below:

Part 1: Meaning of Benchmarking (10 points)

Step 1: Define the TermBenchmarking is the process of comparing an organization’s processes, performance, or practices against a standard or best-in-class example to identify improvementopportunities.

Step 2: PurposeAims to enhance efficiency, quality, or competitiveness by learning from others.

Step 3: ApplicationInvolves measuring metrics (e.g., cost per unit, delivery time) against peers or industry leaders.

Outcome:Drives continuous improvement through comparison.

Part 2: Two Forms of Benchmarking (15 points)

Internal Benchmarking

Step 1: Define the FormCompares performance between different units, teams, or processes within the same organization.

Step 2: ExampleABC Ltd compares delivery times between its UK and US warehouses to share best practices.

Step 3: BenefitsEasy access to data, fosters internal collaboration, and leverages existing resources.

Outcome:Improves consistency and efficiency internally.

Competitive Benchmarking

Step 1: Define the FormCompares performance directly with a competitor in the same industry.

Step 2: ExampleABC Ltd assesses its production costs against a rival manufacturer to identify cost-saving opportunities.

Step 3: BenefitsHighlights competitive gaps and drives market positioning improvements.

Outcome:Enhances external competitiveness.

Exact Extract Explanation:

Definition:The CIPS L5M4 Study Guide states, "Benchmarking involves comparing organizational performance against a reference point to identify areas for enhancement" (CIPS L5M4 Study Guide, Chapter 2, Section 2.6).

Forms:It notes, "Internal benchmarking uses internal data for improvement, while competitive benchmarking focuses on rivals to gain a market edge" (CIPS L5M4 Study Guide, Chapter 2, Section 2.6). Both are vital for supply chain and financial optimization. References: CIPS L5M4 Study Guide, Chapter 2: Supply Chain Performance Management.

Apart from financial measures, what other measures can an organization use to measure the performance of their supply chain? Describe THREE. (25 points)

See the answer in Explanation below:

Beyond financial metrics, organizations can evaluate supply chain performance using non-financial measures that focus on efficiency, effectiveness, and customer satisfaction. Below are three measures, explained step-by-step:

Order Fulfillment Cycle Time (OFCT)

Step 1: Define the MeasureThe total time taken from receiving a customer order to delivering the product or service.

Step 2: ApplicationTrack the duration from order placement to final delivery, including procurement,production, and logistics stages.

Step 3: EvaluationA shorter OFCT indicates a responsive and efficient supply chain, while delays highlight bottlenecks.

Relevance:Measures speed and agility, critical for customer satisfaction and operational efficiency.

Perfect Order Rate (POR)

Step 1: Define the MeasureThe percentage of orders delivered on time, in full, without damage, and with accurate documentation.

Step 2: ApplicationCalculate POR by assessing completed orders against criteria (e.g., 95% of 100 orders meet all standards = 95% POR).

Step 3: EvaluationA high POR reflects reliability and quality; a low rate signals issues in logistics or supplier performance.

Relevance:Gauges end-to-end supply chain accuracy and customer experience.

Supply Chain Flexibility

Step 1: Define the MeasureThe ability to adapt to changes in demand, supply disruptions, or market conditions.

Step 2: ApplicationAssess response time to sudden order increases, supplier failures, or new product introductions.

Step 3: EvaluationMeasured qualitatively (e.g., successful adaptations) or quantitatively (e.g., time to adjust production).

Relevance:Highlights resilience, essential in dynamic or uncertain environments.

Exact Extract Explanation:

The CIPS L5M4 Study Guide emphasizes non-financial supply chain metrics:

Order Fulfillment Cycle Time:"OFCT measures the efficiency of the supply chain process from order to delivery" (CIPS L5M4 Study Guide, Chapter 2, Section 2.3).

Perfect Order Rate:"POR is a key indicator of supply chain reliability and customer satisfaction" (CIPS L5M4 Study Guide, Chapter 2, Section 2.3).

Supply Chain Flexibility:"Flexibility reflects the supply chain’s capacity to respond to volatility, a critical non-financial measure" (CIPS L5M4 Study Guide, Chapter 2, Section 2.4).These align with broader performance management beyond cost. References: CIPS L5M4 Study Guide, Chapter 2: Supply Chain Performance Management.===========

What is meant by the term benchmarking? (10 points) Describe two forms of benchmarking (15 points)

See the answer in Explanation below:

Part 1: Meaning of Benchmarking (10 points)

Step 1: Define the TermBenchmarking is the process of comparing an organization’s processes, performance, or practices against a standard or best-in-class example to identify improvement opportunities.

Step 2: PurposeAims to enhance efficiency, quality, or competitiveness by learning from others.

Step 3: ApplicationInvolves measuring metrics (e.g., cost per unit, delivery time) against peers or industry leaders.

Outcome:Drives continuous improvement through comparison.

Part 2: Two Forms of Benchmarking (15 points)

Internal Benchmarking

Step 1: Define the FormCompares performance between different units, teams, or processes within the same organization.

Step 2: ExampleABC Ltd compares delivery times between its UK and US warehouses to share best practices.

Step 3: BenefitsEasy access to data, fosters internal collaboration, and leverages existing resources.

Outcome:Improves consistency and efficiency internally.

Competitive Benchmarking

Step 1: Define the FormCompares performance directly with a competitor in the same industry.

Step 2: ExampleABC Ltd assesses its production costs against a rival manufacturer to identify cost-saving opportunities.

Step 3: BenefitsHighlights competitive gaps and drives market positioning improvements.

Outcome:Enhances external competitiveness.

Exact Extract Explanation:

Definition:The CIPS L5M4 Study Guide states, "Benchmarking involves comparing organizational performance against a reference point to identify areas for enhancement" (CIPS L5M4 Study Guide, Chapter 2, Section 2.6).

Forms:It notes, "Internal benchmarking uses internal data for improvement, while competitive benchmarking focuses on rivals to gain a market edge" (CIPS L5M4 Study Guide, Chapter 2, Section 2.6). Both are vital for supply chain and financial optimization. References: CIPS L5M4 Study Guide, Chapter 2: Supply Chain Performance Management.

John is looking at the potential of three different projects and is considering the Return on Investment. What is meant by this, and what are the benefits and disadvantages of using this method? Which option should he choose? (25 marks)

See the answer in Explanation below:

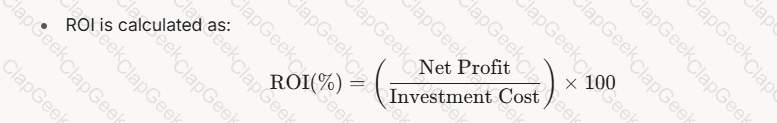

Part 1: What is meant by Return on Investment (ROI)? (8 marks)

Return on Investment (ROI) is a financial metric used to evaluate the efficiency or profitability of an investment by measuring the return generated relative to its cost. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, ROI is a key tool for assessingthe financial viability of projects or contracts, ensuring they deliver value for money. Below is a step-by-step explanation:

Definition:

A math equation with numbers and a square

AI-generated content may be incorrect.

A math equation with numbers and a square

AI-generated content may be incorrect.

Net Profit = Total Returns – Investment Cost.

Purpose:

It helps decision-makers like John compare the financial benefits of projects against their costs.

Example: A project costing £100k that generates £120k in returns has an ROI of 20%.

Part 2: Benefits and Disadvantages of Using ROI (10 marks)

Benefits:

Simplicity and Clarity:

ROI is easy to calculate and understand, providing a straightforward percentage to compare options.

Example: John can quickly see which project yields the highest return.

Focus on Financial Efficiency:

It aligns with L5M4’s emphasis on value for money by highlighting projects that maximize returns.

Example: A higher ROI indicates better use of financial resources.

Comparability:

Allows comparison across different projects or investments, regardless of scale.

Example: John can compare projects with different investment amounts.

Disadvantages:

Ignores Time Value of Money:

ROI does not account for when returns are received, which can skew long-term project evaluations.

Example: A project with returns in Year 3 may be less valuable than one with returns in Year 1.

Excludes Non-Financial Factors:

It overlooks qualitative benefits like quality improvements or strategic alignment.

Example: A project with a lower ROI might offer sustainability benefits.

Potential for Misleading Results:

ROI can be manipulated by adjusting cost or profit definitions, leading to inaccurate comparisons.

Example: Excluding hidden costs (e.g., maintenance) inflates ROI.

Part 3: Which Option Should John Choose? (7 marks)

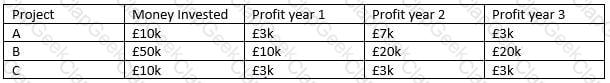

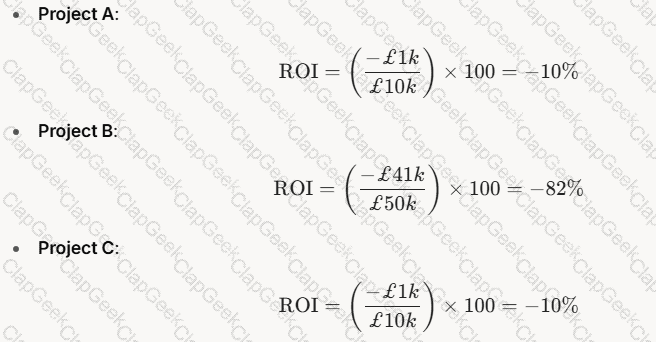

Using the data provided for the three projects, let’s calculate the ROI for each to determine the best option for John. The table is as follows:

A screenshot of a phone

AI-generated content may be incorrect.

A screenshot of a phone

AI-generated content may be incorrect.

Step 1: Calculate Total Profit for Each Project:

Project A: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project B: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project C: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Step 2: Calculate Net Profit (Total Profit – Investment):

Project A: £9k – £10k = -£1k (a loss)

Project B: £9k – £50k = -£41k (a loss)

Project C: £9k – £10k = -£1k (a loss)

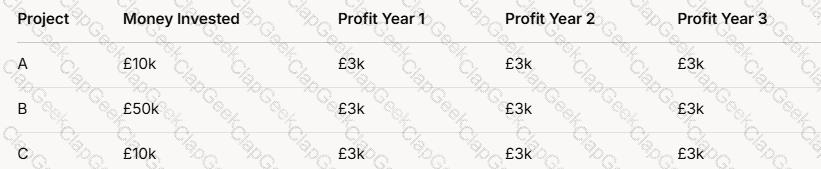

Step 3: Calculate ROI for Each Project:

A group of math equations

AI-generated content may be incorrect.

A group of math equations

AI-generated content may be incorrect.

Step 4: Compare and Choose:

Project A: -10% ROI

Project B: -82% ROI

Project C: -10% ROIAll projects show a negative ROI, meaning none generate a profit over the investment cost. However, Projects A and C have the least negative ROI at -10%, while Project B is significantly worse at -82%. Between A and C, the ROI is identical, but both require the same investment (£10k) and yield the same returns. Therefore, there is no financial difference between A and C based on ROI alone. However, since the question asks for a choice, John should choose eitherProject A or Project Cover Project B, as they minimize losses. Without additional qualitative factors (e.g., strategic fit, risk), either A or C is equally viable. For simplicity, let’s recommendProject A.

Recommendation: John should chooseProject A(or C), as it has a less negative ROI (-10%) compared to Project B (-82%), indicating a smaller financial loss.

Exact Extract Explanation:

Part 1: What is Return on Investment?

The CIPS L5M4 Advanced Contract and Financial Management study guide explicitly covers ROI in the context of financial management tools for evaluating contract or project performance. It defines ROI as "a measure of the gain or loss generated on an investment relative to the amount invested," typically expressed as a percentage. The guide positions ROI as a fundamental metric for assessing "value for money," a core principle of L5M4, especially when selecting projects or suppliers.

Detailed Explanation:

The guide explains that ROI is widely used because it provides a "clear financial snapshot" of investment performance. In John’s case, ROI helps compare the profitability of three projects.

It also notes that ROI is often used in contract management to evaluate supplier performance or project outcomes, ensuring resources are allocated efficiently.

Part 2: Benefits and Disadvantages

The study guide discusses ROI’s role in financial decision-making, highlighting its strengths and limitations, particularly in contract and project evaluations.

Benefits:

Simplicity and Clarity:

Chapter 4 notes that ROI’s "ease of calculation" makes it accessible for quick assessments, ideal for John’s scenario.

Focus on Financial Efficiency:

The guide emphasizes ROI’s alignment with "maximizing returns," ensuring investments like John’s projects deliver financial value.

Comparability:

ROI’s percentage format allows "cross-project comparisons," per the guide, enabling John to evaluate projects with different investment levels.

Disadvantages:

Ignores Time Value of Money:

The guide warns that ROI "does not consider the timing of cash flows," a critical limitation. For John, returns in Year 3 are less valuable than in Year 1 due to inflation or opportunity costs.

Excludes Non-Financial Factors:

L5M4 stresses that financial metrics alone can miss "strategic benefits" like quality or innovation, which might apply to John’s projects.

Potential for Misleading Results:

The guide cautions that ROI can be "distorted" if costs or profits are misreported, a risk John should consider if project data is incomplete.

Part 3: Which Option Should John Choose?

The guide’s focus on ROI as a decision-making tool directly supports the calculation process above. It advises using ROI to "rank investment options" but also to consider broader factors if results are close, as seen with Projects A and C.

Analysis:

The negative ROIs indicate all projects are unprofitable, a scenario the guide acknowledges can occur, suggesting further analysis (e.g., risk, strategic fit). However, based solely on ROI, A and C are better than B.

The guide’s emphasis on minimizing financial loss in poor-performing investments supports choosing A or C, as they have the least negative impact.

Describe 5 parts of the analysis model, first put forward by Porter, in which an organisation can assess the competitive marketplace (25 marks)

See the answer in Explanation below:

The analysis model referred to in the question is Porter’s Five Forces, a framework developed by Michael Porter to assess the competitive environment of an industry and understand the forces that influence an organization’s ability to compete effectively. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, Porter’s Five Forces is a strategic tool used to analyze the marketplace to inform procurement decisions, supplier selection, and contract strategies, ensuring financial and operational efficiency. Below are the five parts of the model, explained in detail:

Threat of New Entrants:

Description: This force examines how easy or difficult it is for new competitors to enter the market. Barriers to entry (e.g., high capital requirements, brand loyalty, regulatory restrictions) determine the threat level.

Impact: High barriers protect existing players, while low barriers increase competition, potentially driving down prices and margins.

Example: In the pharmaceutical industry, high R&D costs and strict regulations deter new entrants, reducing the threat.

Bargaining Power of Suppliers:

Description: This force assesses the influence suppliers have over the industry, based on their number, uniqueness of offerings, and switching costs for buyers.

Impact: Powerful suppliers can increase prices or reduce quality, squeezing buyer profitability.

Example: In the automotive industry, a limited number of specialized steel suppliers may have high bargaining power, impacting car manufacturers’ costs.

Bargaining Power of Buyers:

Description: This force evaluates the influence buyers (customers) have on the industry, determined by their number, purchase volume, and ability to switch to alternatives.

Impact: Strong buyer power can force price reductions or demand higher quality, reducing profitability.

Example: In retail, large buyers like supermarkets can negotiate lower prices from suppliers due to their high purchase volumes.

Threat of Substitute Products or Services:

Description: This force analyzes the likelihood of customers switching to alternative products or services that meet the same need, based on price, performance, or availability.

Impact: A high threat of substitutes limits pricing power and profitability.

Example: In the beverage industry, the rise of plant-based milk (e.g., almond milk) poses a substitute threat to traditional dairy milk.

Competitive Rivalry within the Industry:

Description: This force examines the intensity of competition among existing firms, influenced by the number of competitors, market growth, and product differentiation.

Impact: High rivalry leads to price wars, increased marketing costs, or innovation pressures, reducing profitability.

Example: In the smartphone industry, intense rivalry between Apple and Samsung drives innovation but also squeezes margins through competitive pricing.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide explicitly references Porter’s Five Forces as a tool for "analyzing the competitive environment" to inform procurement and contract strategies. It is presented in the context of market analysis, helping organizations understand external pressures that impact supplier relationships, pricing, and financial outcomes. The guide emphasizes its relevance in strategic sourcing (as in Question 11) and risk management, ensuring buyers can negotiate better contracts and achieve value for money.

Detailed Explanation of Each Force:

Threat of New Entrants:

The guide notes that "barriers to entry influence market dynamics." For procurement, a low threat (e.g., due to high entry costs) means fewer suppliers, potentially increasing supplier power and costs. A buyer might use this insight to secure long-term contracts with existing suppliers to lock in favorable terms.

Bargaining Power of Suppliers:

Chapter 2 highlights that "supplier power affects cost structures." In L5M4, this is critical for financial management—high supplier power (e.g., few suppliers of a rare material) can inflate costs, requiring buyers to diversify their supply base or negotiate harder.

Bargaining Power of Buyers:

The guide explains that "buyer power impacts pricing and margins." For a manufacturer like XYZ Ltd (Question 7), strong buyer power from large clients might force them to source cheaper raw materials, affecting supplier selection.

Threat of Substitute Products or Services:

L5M4’s risk management section notes that "substitutes can disrupt supply chains." A high threat (e.g., synthetic alternatives to natural materials) might push a buyer to collaborate with suppliers on innovation to stay competitive.

Competitive Rivalry within the Industry:

The guide states that "rivalry drives market behavior." High competition might lead to price wars, prompting buyers to seek cost efficiencies through strategic sourcing or supplier development (Questions 3 and 11).

Application in Contract Management:

Porter’s Five Forces helps buyers assess the marketplace before entering contracts. For example, if supplier power is high (few suppliers), a buyer might negotiate longer-term contracts to secure supply. If rivalry is intense, they might prioritize suppliers offering innovation to differentiate their products.

Financially, understanding these forces ensures cost control—e.g., mitigatingsupplier power reduces cost inflation, aligning with L5M4’s focus on value for money.

Practical Example for XYZ Ltd (Question 7):

Threat of New Entrants: Low, due to high setup costs for raw material production, giving XYZ Ltd fewer supplier options.

Supplier Power: High, if raw materials are scarce, requiring XYZ Ltd to build strong supplier relationships.

Buyer Power: Moderate, as XYZ Ltd’s clients may have alternatives, pushing for competitive pricing.

Substitutes: Low, if raw materials are specialized, but XYZ Ltd should monitor emerging alternatives.

Rivalry: High, in manufacturing, so XYZ Ltd must source efficiently to maintain margins.

This analysis informs XYZ Ltd’s supplier selection and contract terms, ensuring financial and operational resilience.

Broader Implications:

The guide advises using Porter’s Five Forces alongside other tools (e.g., SWOT analysis) for a comprehensive market view. It also stresses that these forces are dynamic—e.g., new regulations might lower entry barriers, increasing competition over time.

In financial management, the model helps buyers anticipate cost pressures (e.g., from supplier power) and negotiate contracts that mitigate risks, ensuring long-term profitability.

With reference to the SCOR Model, how can an organization integrate operational processes throughout the supply chain? What are the benefits of doing this? (25 points)

See the answer in Explanation below:

Part 1: How to Integrate Operational Processes Using the SCOR ModelThe Supply Chain Operations Reference (SCOR) Model provides a framework to integrate supply chain processes. Below is a step-by-step explanation:

Step 1: Understand SCOR ComponentsSCOR includes five core processes: Plan, Source, Make, Deliver, and Return, spanning the entire supply chain from suppliers to customers.

Step 2: Integration Approach

Plan:Align demand forecasting and resource planning across all supply chain partners.

Source:Standardize procurement processes with suppliers for consistent material flow.

Make:Coordinate production schedules with demand plans and supplier inputs.

Deliver:Streamline logistics and distribution to ensure timely customer delivery.

Return:Integrate reverse logistics for returns or recycling across the chain.

Step 3: ImplementationUse SCOR metrics (e.g., delivery reliability, cost-to-serve) and best practices to align processes, supported by technology like ERP systems.

Outcome:Creates a cohesive, end-to-end supply chain operation.

Part 2: Benefits of Integration

Step 1: Improved EfficiencyReduces redundancies and delays by synchronizing processes (e.g., faster order fulfillment).

Step 2: Enhanced VisibilityProvides real-time data across the chain, aiding decision-making.

Step 3: Better Customer ServiceEnsures consistent delivery and quality, boosting satisfaction.

Outcome:Drives operational excellence and competitiveness.

Exact Extract Explanation:

The CIPS L5M4 Study Guide details the SCOR Model:

Integration:"SCOR integrates supply chain processes—Plan, Source, Make, Deliver, Return—ensuring alignment from suppliers to end customers" (CIPS L5M4 Study Guide, Chapter 2, Section 2.2). It emphasizes standardized workflows and metrics.

Benefits:"Benefits include increased efficiency, visibility, and customer satisfaction through streamlined operations" (CIPS L5M4 Study Guide, Chapter 2, Section 2.2).This supports strategic supply chain management in procurement. References: CIPS L5M4 Study Guide, Chapter 2: Supply Chain Performance Management.===========

TESTED 21 Feb 2026

Copyright © 2014-2026 ClapGeek. All Rights Reserved