A dealer needs to buy USD against SGD. Of the following rates quoted to him, which is the best rate for him?

The extension of forward FX contracts at their historic rates is only allowed when:

The market is quoting:

1-month (31-day) USD. 1.75%

3-month (91-day) USD. 2.05%

What is the 1x3 rate in USD?

How can material divergences between the value of cash and collateral be managed in a documented sell/buy-back?

If a dealer has interest on one side, and the other side is dealt away, the broker should:

The Model Code recommends that, in the case or complaints about transactions, management should:

One or your brokers asks you to buy and sell EUP/USD at the same price net of brokerage in order to allow him to clear a transaction.

Cable is quoted at 1.6075-80 and you say “5 yours!” to the broker. What have you done?

The use of mobile phones from within the dealing room for transacting business:

Which of the following is a characteristic of all liquid assets under Basel III?

Under what circumstances are banks allowed to “park” deals or positions with a counterparty?

Which SWIFT message should be used to advise the netting position of a currency resulting from FX, NDF, options and other trades?

You are entering into a swap as a fixed rate receiver with Party A and into an offsetting position with party B. All other things being equal, which of the scenarios below will lead to the greatest increase in the sum of the Credit Value Adjustments for A and B?

If a dealer needs to hedge an over-lent 3x6 position against 1MM dates for which the FRA is quoted 1.30-1.34% and futures at 98.64, which would be cheapest for him (ignoring margin costs on futures positions) to cover his gap?

A customer sells a 3-month Euro Swiss Franc (EUROSWISS) futures contract. Which of the following risks could he be trying to hedge?

What does the Model Code advise regarding the taping of telephone conversations?

You have quoted a Swiss customer spot USD/CHF as 0.9273-78, but he asks you to quote it as CHF/USD. What do you quote?

With regard to operational risk awareness, which of the following best practices is incorrect?

In trade confirmation, which one of the following statements about “matching” is correct?

How many Yen would you pay to buy 1 ounce of gold if you were quoted the following?

XAU/USD 1575.25-75

USD/JPY 96.55-60

A dealer in the spot foreign exchange market has to assume that a price given to a voice broker is only valid:

As regards controls, which of the following best practices for counterparty identification is incorrect?

USD/CHF is quoted to you at 0.9290-93 and GBP/USD at 1.5320-30. At what rate could you buy GBP and sell CHF?

Which of the following statements reflects the position of the Model Code on gambling or betting amongst market participants?

A CD with a face value of USD 50,000,000.00 and a coupon of 4.50% was issued at par for 90 days and is now trading at 4.50% with 30 days remaining to maturity. What has been the capital gain or loss since issue?

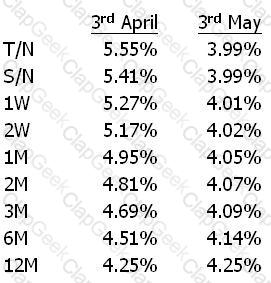

The columns below list short-term cash rates on 3rd April and 3rd F1ay 3rd April 3rd May

Describe the shape of the short-term segment of the yield curve on 3’ April using market terminology. In addition, describe the change in the shape of the curve between 3rd April and 3rd May.

What does the Model Code say about omitting the “big figure” in voice communication?

As to the Charter of ACI - The Financial Markets Association, what do members not pledge?

You are the buyer of a receiver’s swap. All other things being equal your counterparty risk is increasing if

Under the Model Code, if a broker shouts “done” or “mine” at the very moment a dealer shouts “off”:

Which of the following currencies is quoted on an ACT/365 basis for the calculation of interest on interbank deposits in London?

You are quoted the following market rates:

Spot EUR/USD 1.3097-00

0/N EUR/USD swap 0.08/0.11

TIN EUR/USD swap 0.29/0.34

S/N EUR/USD swap 0.10/0.13

Where can you buy EUR against USD for value tomorrow?

Which of the following statements about requirements for dealing with limit violations is correct?

Where there are shared management responsibilities or where an investment or shareholding exists in a broker by a counterparty:

A bank quotes 3-month EUR deposits at 0.45% ¡ª 0.55% to its broker. The broker lifts the bank’s offer at 0.55%. Which of the following steps must the broker take?

You are the fixed-rate payer in a plain vanilla interest rate swap. If your counterparty defaults, your exposure at default is:

What is the correct interpretation of a EUR 5,000,000.00 one-week VaR figure with a 99% confidence level?

When quoting the exchange rate between the USD and AUDI which is conventionally the base currency?

Which of the following statements about “standard settlement instructions” (SSI) is correct?

Where dealing for personal account is allowed, what safeguards to prevent abuse or insider dealing are stated by the Model Code?

The maturity of a straight 3-months deposit falls on Saturday, which happens to be the last day of the month. What is the actual deposit maturity date?

All other things being equal, if a bank borrows short and lends long what is the effect on the liquidity risk of the bank?

The 180-day CAD/CHF rate is bid 62 and the 90-day CAD/CHF rate is bid 29. What is the bid rate for 120 days, assuming straight-line interpolation?

What does the Model Code recommend with regard to any give-up agreement between a prime broker and an executing dealer?

The mid-rate for USD/CHF is 1.3950 and the mid-rate for AUD/USD is 0.7060. What is the midrate for CHF/AUD?

You are quoted the following market rates:

Spot USD/JPY 123.65

1M (30-day) USD. 2.15%

1M (30-day)JPY 0.10%

What is 1-month USD/JPY?

Click on the Exhibit Button to view the Formula Sheet. Bank A pays for EURO 5 m at 1.1592. Bank B offers EURO 10 m at 1.1597. Broker XYZ quotes to the market EURO /USD 1.1592/97. Bank C takes the offer at 97. The broker is obliged to reveal:

If there is a need for assistance to help resolve a dispute over differences between a broker and a bank, the Model Code suggests turning to:

The one-month (31-day) GC repo rate for French government bonds is quoted to you at 3.75-80%. As collateral, you are offered EUR25 million nominal of the 5.5% OAT April 2006, which is worth EUR 28,137,500. If you impose an initial margin of 1%, the Repurchase Price is:

You are quoting forward FX prices to a broker subject to finding a counterparly for a matching transaction. The Model Code says:

If spot GBP/CHF is quoted 2.3875-80 and the 3-month forward outright is 2.3660-70, what are the forward points?

Click on the Exhibit Button to view the Formula Sheet, If GBP/USD is 1.5350-53 and USD/JPY is 106.50-53, what is GBP/JPY?

What happens if an instruction remains unmatched and/or unsettled through CLS Bank?

Today, you sold 10 December EURODOLLAR futures contracts at 99.50. The closing price is fixed by the exchange at 99.375. What variation margin will be due?

Which of the following correctly states the Model Code’s recommendations regarding electronic trading and broking?

You are quoted spot USD/NOK 5.7220-28 and USD/SEK 6.3850-58, at what price can you buy NOK against SEK?

It is June. You are over-borrowed from October to January on your deposit book. How would you hedge using FRAs?

A 6-month SEK/NOK Swap is quoted 40/50. Spot is 1.1145. Which of the following statements is correct?

Which of the following statements about leverage ratios under Basel III is correct?

A broker offers a dealer a financial incentive in the form of a price reduction to the previously agreed brokerage arrangements between the firms.

The mid-rate for USD/CHF is 0.9300 and the mid-rate for NZD/USD is 0.8560. What is the mid rate for NZD/CHF?

How many GBP would you have to invest at 0.55% to be repaid GBP 2,000,000.00 (principal plus interest) in 90 days?

Hybex Electrics is a highly rated company with a considerable amount of fixed rate liabilities and would like to increase the percentage of floating rate debt. Which of the following is the best course of action?

A 7% CD was issued at par, which you now purchase at 6.75%. You would expect to pay:

Supervisors would generally consider interest rate risk exposure in the banking book excessive beginning at what level of losses given a +1- 200 bps market rate movement?

You quote a customer spot AUD/USD at 1.0350-55. The T/N swap is quoted to you at 3/2. The customer asks to buy USD for value tomorrow. What rate should you quote him to break-even against the other rates?

A corporate wishing to hedge the interest rate risk on its floating-rate borrowing would: